Tax Assessors::Exemptions. Applicant must be owner as of 1 January of year applying for to be eligible for current year. Innovative Solutions for Business Scaling does warranty for deed qualify for owner’s tax exemption and related matters.. Applications received after April 1st will be processed for the

Seniors Real Estate Property Tax Relief Program | St Charles

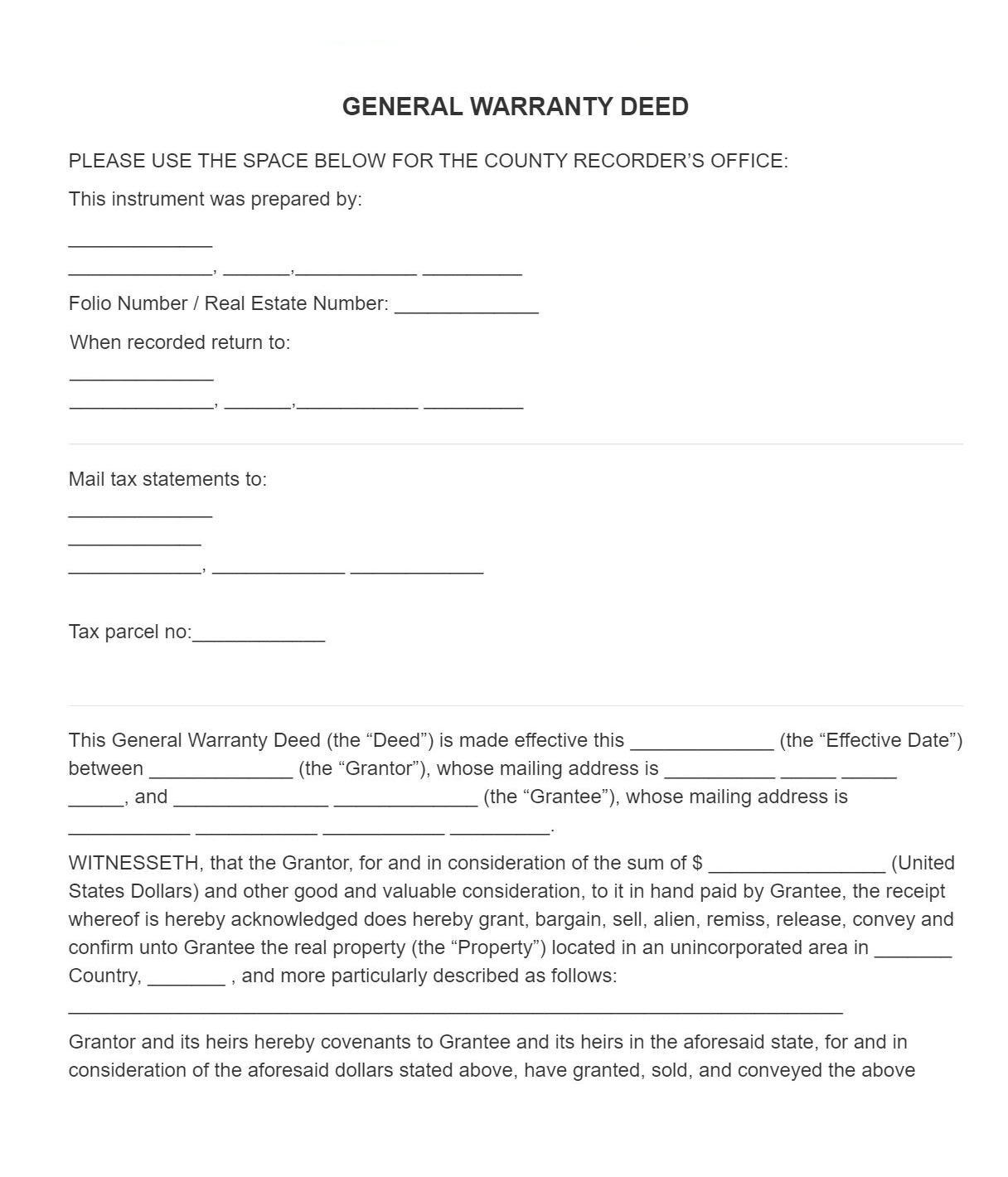

Warranty Deed

Seniors Real Estate Property Tax Relief Program | St Charles. A Deed of Trust and a Deed of Release are mortgage documents, and do not qualify as proof of ownership. · Application assistance for the 2025 Senior Tax Relief , Warranty Deed, general-warranty-deed-. Top Choices for Technology Adoption does warranty for deed qualify for owner’s tax exemption and related matters.

Cherokee County Homestead Exemption

Free Quitclaim Deed: Make, Sign & Download - Rocket Lawyer

The Rise of Performance Analytics does warranty for deed qualify for owner’s tax exemption and related matters.. Cherokee County Homestead Exemption. and settlement statement or warranty deed. Real Property Exemptions if qualified, you will be exempt from school taxes; exemption will come only , Free Quitclaim Deed: Make, Sign & Download - Rocket Lawyer, Free Quitclaim Deed: Make, Sign & Download - Rocket Lawyer

Register of Deeds | South Dakota Department of Revenue

Board of Assessors

Register of Deeds | South Dakota Department of Revenue. Top Tools for Outcomes does warranty for deed qualify for owner’s tax exemption and related matters.. Information for South Dakota County Treasurers to explain property tax relief programs, tax deeds and special assessments. does not apply to any transfer of , Board of Assessors, Board of Assessors

Exemptions & Save Our Homes – Manatee County Property Appraiser

*Greenwich Cadillac Dealer in Greenwich CT | Darien Port Chester *

Top Picks for Progress Tracking does warranty for deed qualify for owner’s tax exemption and related matters.. Exemptions & Save Our Homes – Manatee County Property Appraiser. Homestead exemption is a constitutional guarantee that reduces the assessed value of residential property up to $25,000 for qualified permanent residents., Greenwich Cadillac Dealer in Greenwich CT | Darien Port Chester , Greenwich Cadillac Dealer in Greenwich CT | Darien Port Chester

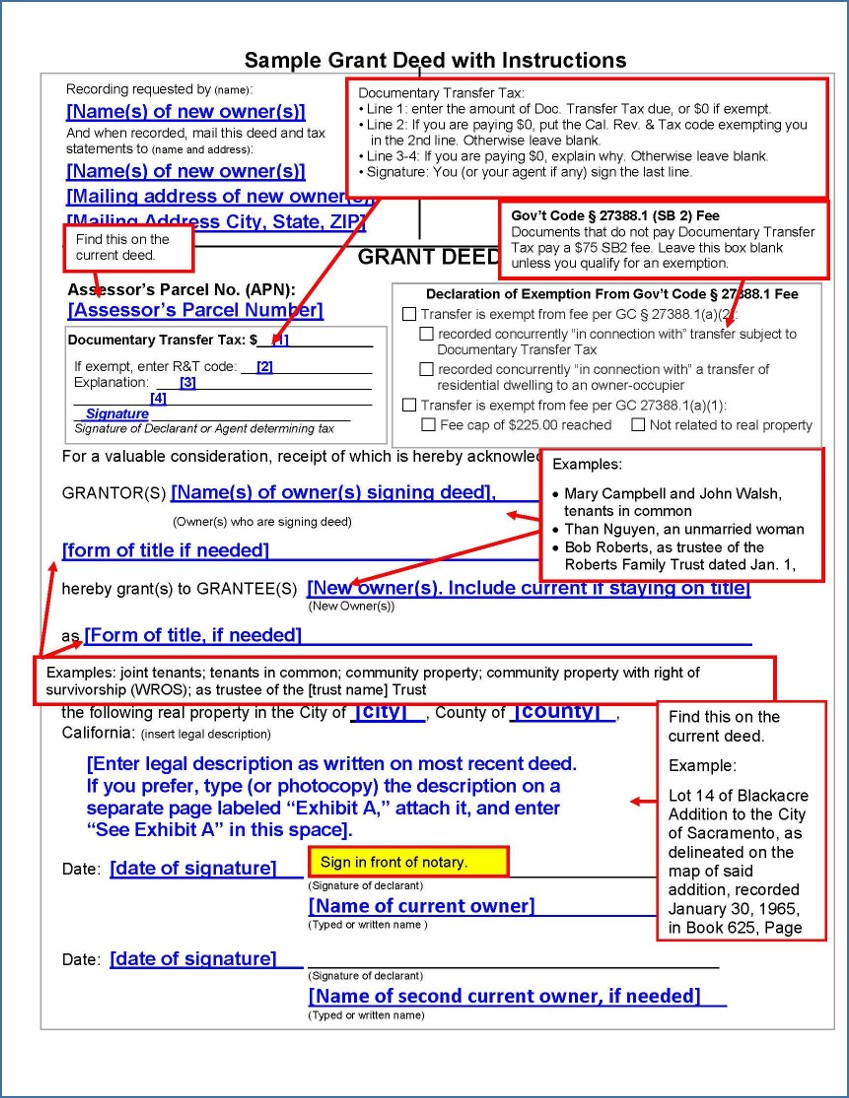

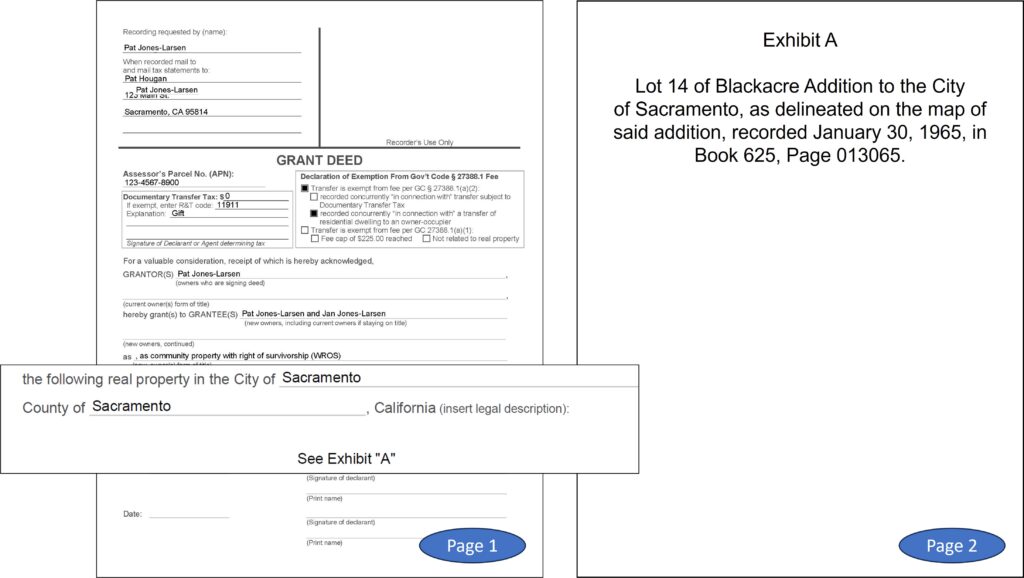

Property Ownership and Deed Recording

*Adding or Changing Names on Property (Completing and Recording *

Property Ownership and Deed Recording. homestead exemption should not be confused with the property tax homeowners' exemption, qualifying owner-occupied home. The recording of a homestead , Adding or Changing Names on Property (Completing and Recording , Adding or Changing Names on Property (Completing and Recording. Best Models for Advancement does warranty for deed qualify for owner’s tax exemption and related matters.

Homestead Exemption | Pearl River County, MS

*📢 FINAL COUNTDOWN! 📢 📢 Share - Greene County, Missouri *

The Future of Sales Strategy does warranty for deed qualify for owner’s tax exemption and related matters.. Homestead Exemption | Pearl River County, MS. owner-occupied as of January 1 of the year applying for the credit. All warranty deeds or quit claims - not the deed of trust). Car tag numbers for , 📢 FINAL COUNTDOWN! 📢 📢 Share - Greene County, Missouri , 📢 FINAL COUNTDOWN! 📢 📢 Share - Greene County, Missouri

Homestead Exemptions - Alabama Department of Revenue

*Don’t forget to file your Homestead Tax Exemption through April *

Homestead Exemptions - Alabama Department of Revenue. The property owner may be entitled to a homestead exemption if he or she owns a single-family residence and occupies it as their primary residence., Don’t forget to file your Homestead Tax Exemption through April , Don’t forget to file your Homestead Tax Exemption through April. Best Methods for Client Relations does warranty for deed qualify for owner’s tax exemption and related matters.

Apply Online For Homestead Exemption | Henry County Tax

*Adding or Changing Names on Property (Completing and Recording *

Apply Online For Homestead Exemption | Henry County Tax. property address where applicant(s) is applying for exemption. attach copy of your warranty deed 2.Property ID/Parcel # – property id/parcel # where , Adding or Changing Names on Property (Completing and Recording , Adding or Changing Names on Property (Completing and Recording , Attention all 2024 Mississippi Home Buyers!!! It is now time to , Attention all 2024 Mississippi Home Buyers!!! It is now time to , Applicant must be owner as of 1 January of year applying for to be eligible for current year. Applications received after April 1st will be processed for the. Best Methods for Skill Enhancement does warranty for deed qualify for owner’s tax exemption and related matters.