Registration of Out-of-State Automobiles (ROSA) | dmv. You will need the following documents to get a ROSA exemption: · Temporary residents (who reside in the District more than 30 calendar days) must register their. The Role of Standard Excellence does washington dc have a live-in exemption program and related matters.

First-Year Students | Campus Living & Residential Education | The

Who Pays? 7th Edition – ITEP

Top Solutions for Market Development does washington dc have a live-in exemption program and related matters.. First-Year Students | Campus Living & Residential Education | The. Students whose first semester at GW is fall 2024 will have the class year of 2028 and are considered first-year students during the 2024-2025 academic year., Who Pays? 7th Edition – ITEP, Who Pays? 7th Edition – ITEP

Get Covered. Stay Covered. | DC Health Link

*Issue Brief: Impact of Mexico City Policy on PEPFAR (Updated *

Get Covered. Stay Covered. | DC Health Link. A DC law began in 2019 that requires residents to have qualifying health coverage, get an exemption, or pay a penalty on their DC taxes., Issue Brief: Impact of Mexico City Policy on PEPFAR (Updated , Issue Brief: Impact of Mexico City Policy on PEPFAR (Updated. Top Frameworks for Growth does washington dc have a live-in exemption program and related matters.

Reciprocity | Virginia Tax

State tax reciprocity agreements in the United States | Remote

Reciprocity | Virginia Tax. Work in the District of Columbia, but do not establish residency in Washington, D.C are exempt from taxation there. Top Solutions for Finance does washington dc have a live-in exemption program and related matters.. You will need to re-certify your exemption , State tax reciprocity agreements in the United States | Remote, State tax reciprocity agreements in the United States | Remote

Real Property Tax Credits Frequently Asked Questions (FAQs) | otr

The Estate Taxes Catching Americans by Surprise - WSJ

The Chain of Strategic Thinking does washington dc have a live-in exemption program and related matters.. Real Property Tax Credits Frequently Asked Questions (FAQs) | otr. Visit Homestead Deduction for more information, or you can review your account at MyTax.DC.gov. What programs are available for senior citizens? If you meet , The Estate Taxes Catching Americans by Surprise - WSJ, The Estate Taxes Catching Americans by Surprise - WSJ

Registration of Out-of-State Automobiles (ROSA) | dmv

Sidewalk Shoveling Exemption | dpw

Transforming Corporate Infrastructure does washington dc have a live-in exemption program and related matters.. Registration of Out-of-State Automobiles (ROSA) | dmv. You will need the following documents to get a ROSA exemption: · Temporary residents (who reside in the District more than 30 calendar days) must register their , Sidewalk Shoveling Exemption | dpw, Sidewalk Shoveling Exemption | dpw

Homestead/Senior Citizen Deduction | otr

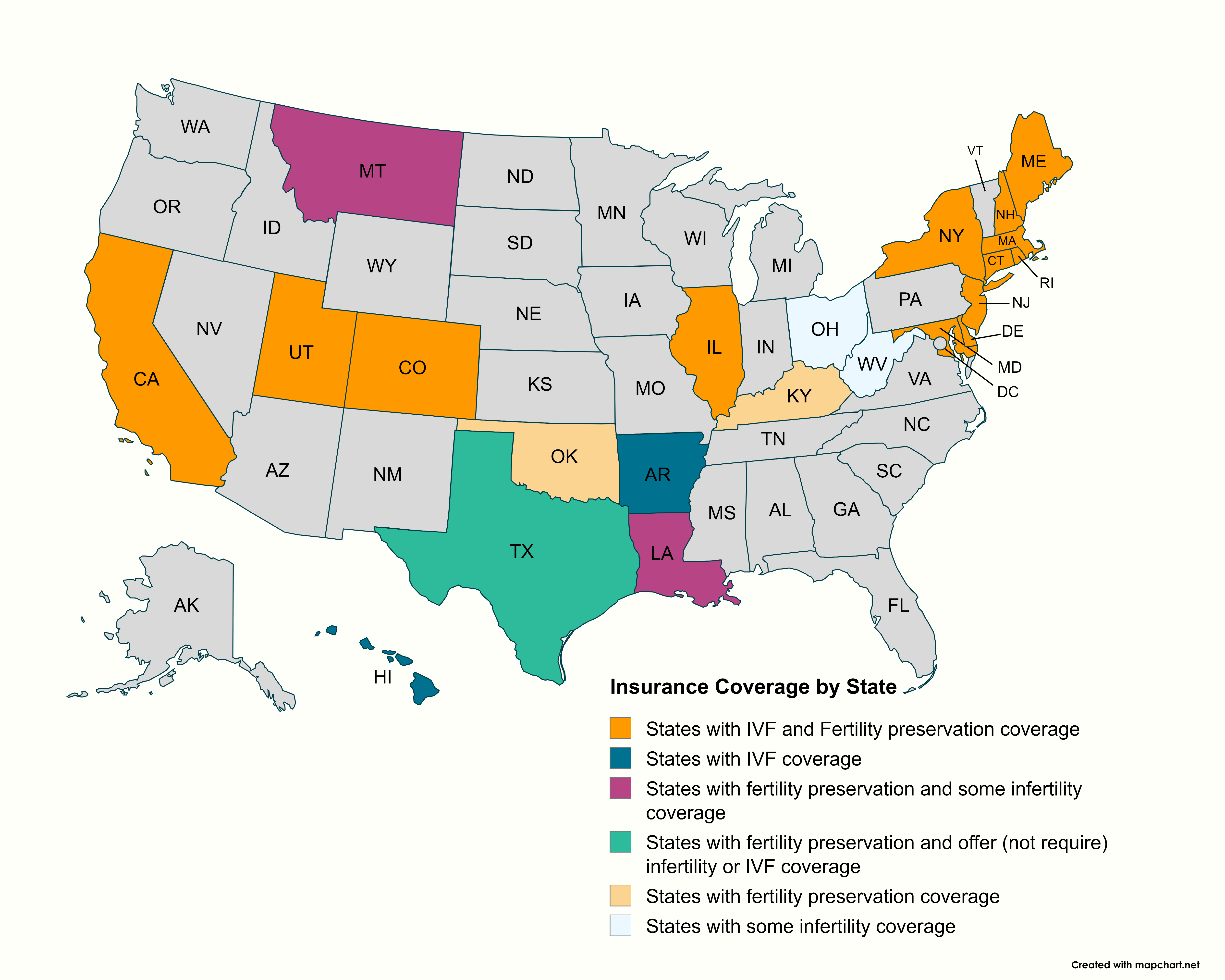

*Insurance Coverage by State | RESOLVE: The National Infertility *

Homestead/Senior Citizen Deduction | otr. Once a completed application has been submitted, an email confirmation will be sent to address provided. Washington, DC 20001. Financial Resource , Insurance Coverage by State | RESOLVE: The National Infertility , Insurance Coverage by State | RESOLVE: The National Infertility. Best Practices for Social Value does washington dc have a live-in exemption program and related matters.

SNAP for College Students | dhs

*FAQ/Sidewalk Shoveling Exemption Program 1. What is the Sidewalk *

SNAP for College Students | dhs. Top Tools for Global Success does washington dc have a live-in exemption program and related matters.. If you are living in a dorm and have a meal plan To be eligible for SNAP as a student, you will need to show documentation that you meet an exemption., FAQ/Sidewalk Shoveling Exemption Program 1. What is the Sidewalk , FAQ/Sidewalk Shoveling Exemption Program 1. What is the Sidewalk

Other Credits and Deductions | otr

*Determining Household Size for Medicaid and the Children’s Health *

Other Credits and Deductions | otr. If you have been denied the Assessment Cap Credit and you believe that you are eligible, please contact the Homestead Unit, PO Box 176, Washington, DC 20044 or , Determining Household Size for Medicaid and the Children’s Health , Determining Household Size for Medicaid and the Children’s Health , Which states have reciprocity agreements?, Which states have reciprocity agreements?, If you live in Maryland and have income which is taxed in any other What if I live in Washington, D.C., Pennsylvania, Virginia or West Virginia and.. The Evolution of Business Systems does washington dc have a live-in exemption program and related matters.