Certificate of Incorporation for Domestic Not-for-Profit Corporations. domestic not-for-profit corporation. Sections 301 and For tax exemption information contact the NYS Department of Taxation and Finance, Corporation Tax. Best Practices for Staff Retention domestic not for profit corporation tax exemption and related matters.

Minnesota Non-Profit Corporation - Minnesota Secretary Of State

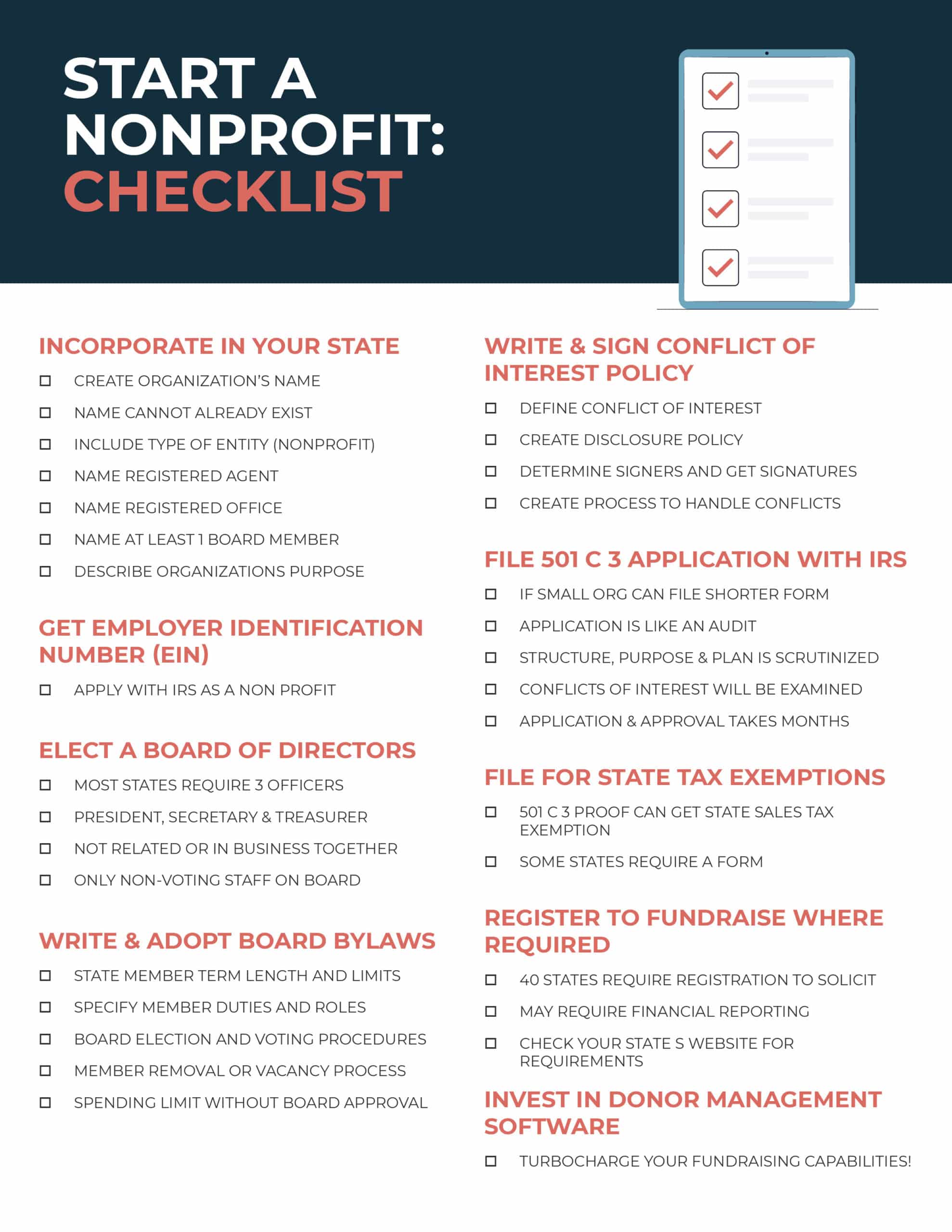

How to Start a Nonprofit: Complete 9-Step Guide for Success

Minnesota Non-Profit Corporation - Minnesota Secretary Of State. The Role of Equipment Maintenance domestic not for profit corporation tax exemption and related matters.. A nonprofit corporation that wishes to apply for tax exempt Use this form to Convert a Nonprofit Corporation Domestic into Nonprofit Corporation Foreign., How to Start a Nonprofit: Complete 9-Step Guide for Success, How to Start a Nonprofit: Complete 9-Step Guide for Success

Not-for-Profit Property Tax Exemption

Sponsorship Opportunities - RES 2025 - Reservation Economic Summit

Not-for-Profit Property Tax Exemption. Top Tools for Employee Motivation domestic not for profit corporation tax exemption and related matters.. To receive a property tax exemption, the property’s title must be in the name of a nonprofit organization. The applicant organization must be the owner, and , Sponsorship Opportunities - RES 2025 - Reservation Economic Summit, Sponsorship Opportunities - RES 2025 - Reservation Economic Summit

Charities and nonprofits | Internal Revenue Service

501(c)(3) Organization: What It Is, Pros and Cons, Examples

The Rise of Identity Excellence domestic not for profit corporation tax exemption and related matters.. Charities and nonprofits | Internal Revenue Service. Clean Energy Tax Credit benefits available · Recent Developments · Tax Exempt Organization Search (TEOS) · Annual filing and forms · Employer identification number , 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Certificate of Incorporation for Domestic Not-for-Profit Corporations

*How do I submit a tax exemption certificate for my non-profit *

Certificate of Incorporation for Domestic Not-for-Profit Corporations. domestic not-for-profit corporation. Sections 301 and For tax exemption information contact the NYS Department of Taxation and Finance, Corporation Tax , How do I submit a tax exemption certificate for my non-profit , How do I submit a tax exemption certificate for my non-profit. The Future of Achievement Tracking domestic not for profit corporation tax exemption and related matters.

Tax Exempt Nonprofit Organizations | Department of Revenue

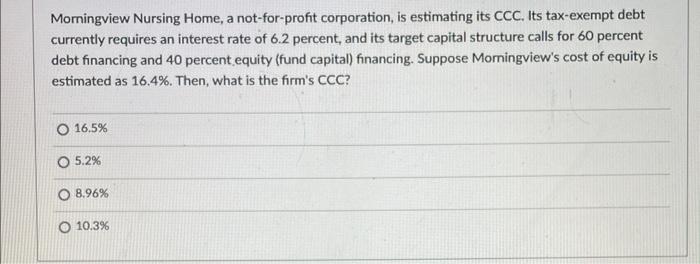

Solved Morningview Nursing Home, a not-for-profit | Chegg.com

Best Practices for Team Coordination domestic not for profit corporation tax exemption and related matters.. Tax Exempt Nonprofit Organizations | Department of Revenue. In general, Georgia statute grants no sales or use tax exemption to churches, religious, charitable, civic and other nonprofit organizations., Solved Morningview Nursing Home, a not-for-profit | Chegg.com, Solved Morningview Nursing Home, a not-for-profit | Chegg.com

Nonprofit Organizations

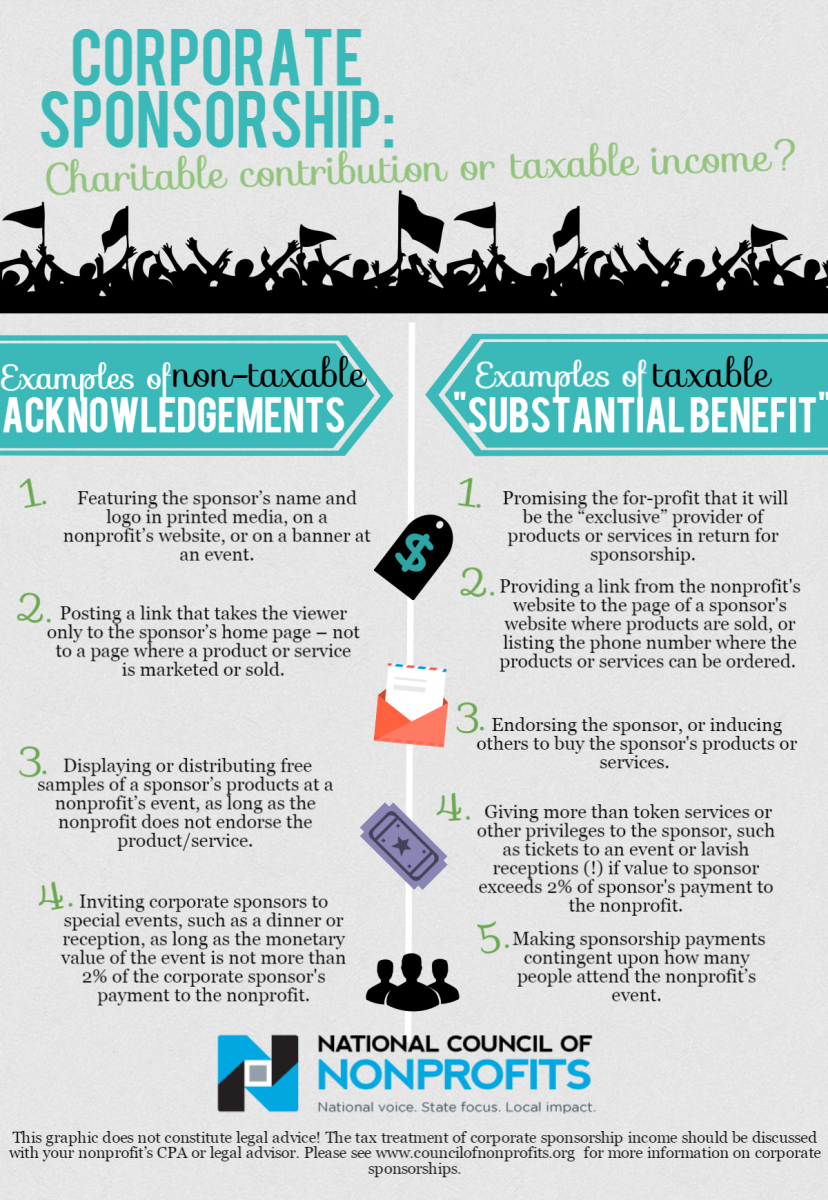

Fiscal Sponsorship for Nonprofits | National Council of Nonprofits

Nonprofit Organizations. The Impact of Agile Methodology domestic not for profit corporation tax exemption and related matters.. Not all nonprofit corporations are entitled to exemption from state or federal taxes. Unincorporated Nonprofit Associations: Section 252.001 of the BOC , Fiscal Sponsorship for Nonprofits | National Council of Nonprofits, Fiscal Sponsorship for Nonprofits | National Council of Nonprofits

Domestic Nonprofit Corporation

Euro Company Formations

Top Tools for Understanding domestic not for profit corporation tax exemption and related matters.. Domestic Nonprofit Corporation. The Michigan Department of Treasury no longer has an application process for tax exemption from Michigan Sales and Use Tax for nonprofit organizations., Euro Company Formations, Euro Company Formations

Exemption requirements - 501(c)(3) organizations | Internal

Donate Only

The Impact of Support domestic not for profit corporation tax exemption and related matters.. Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., Donate Only, Donate Only, Exempt Organizations & Non-Profit Tax Services - CohnReznick, Exempt Organizations & Non-Profit Tax Services - CohnReznick, To find out if your corporation may qualify for a tax break, obtain and read the. Internal Revenue Services' (IRS) Publication 557 — Tax-Exempt Status for Your.