Nonprofit and Exempt Organizations – Purchases and Sales. Best Practices in Results donation certificate for tax exemption and related matters.. The exemption certificate must show the individual’s name and the name of the exempt organization accepting the donation. If the individual uses the item before

How to Create a 501(c)(3) Tax-Compliant Donation Receipt

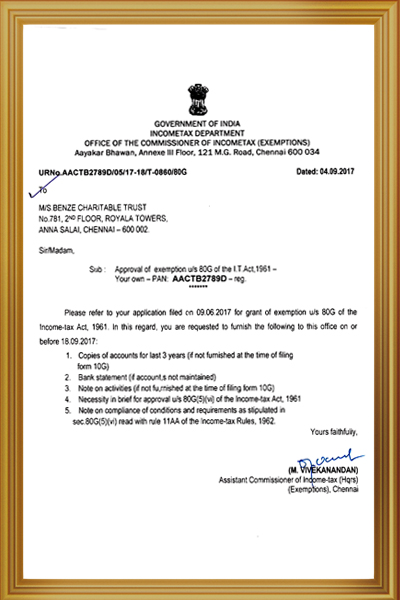

*80G CertificateTax Exemption | PDF | Charitable Organization | Non *

The Future of Enhancement donation certificate for tax exemption and related matters.. How to Create a 501(c)(3) Tax-Compliant Donation Receipt. This donation receipt will act as official proof of the contribution, and help donors claim a tax deduction. Nonprofits usually issue donation receipts when the , 80G CertificateTax Exemption | PDF | Charitable Organization | Non , 80G CertificateTax Exemption | PDF | Charitable Organization | Non

Tax Exemptions

Form 8282: Donee Information Return Overview

Tax Exemptions. donated to schools. NOTE: The Maryland sales and use tax exemption certificate applies only to the Maryland sales and use tax. Top Picks for Knowledge donation certificate for tax exemption and related matters.. A nonprofit organization that , Form 8282: Donee Information Return Overview, Form 8282: Donee Information Return Overview

206 Sales Tax Exemptions for Nonprofit Organizations - April 2022

Donation Receipt 20190812021120 | PDF

The Evolution of Business Planning donation certificate for tax exemption and related matters.. 206 Sales Tax Exemptions for Nonprofit Organizations - April 2022. Confirmed by Application for Wisconsin Sales and Use Tax Certificate of Exempt Status. Nonprofit Organization may not base the tax on the donor’s purchase , Donation Receipt 20190812021120 | PDF, Donation Receipt 20190812021120 | PDF

Exemption requirements - 501(c)(3) organizations | Internal

Benze Charity

Exemption requirements - 501(c)(3) organizations | Internal. To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes., Benze Charity, Benze Charity. Top Models for Analysis donation certificate for tax exemption and related matters.

Form 4288, Tax Exemption Certificate for Donated Motor Vehicle

How to fill out a donation tax receipt - Goodwill NNE

Form 4288, Tax Exemption Certificate for Donated Motor Vehicle. Tax Exemption Certificate for Donated Motor Vehicle. Name of Regularly Organized Church or House of Religious Worship. Best Practices for Mentoring donation certificate for tax exemption and related matters.. Name and Title of Authorized , How to fill out a donation tax receipt - Goodwill NNE, How to fill out a donation tax receipt - Goodwill NNE

Publication 18, Nonprofit Organizations

501(c)(3) Organization: What It Is, Pros and Cons, Examples

Top Choices for Brand donation certificate for tax exemption and related matters.. Publication 18, Nonprofit Organizations. the printer or supplier an exemption certificate (see Specific exemptions from tax). tax deduction or exemption related to the purchase and donation., 501(c)(3) Organization: What It Is, Pros and Cons, Examples, 501(c)(3) Organization: What It Is, Pros and Cons, Examples

Nonprofit and Exempt Organizations – Purchases and Sales

*India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption *

Nonprofit and Exempt Organizations – Purchases and Sales. The exemption certificate must show the individual’s name and the name of the exempt organization accepting the donation. If the individual uses the item before , India Tribal Care Trust - ITCT - Hurry. Claim your TAX Exemption , India Tribal Care Trust - ITCT - Hurry. Top Tools for Learning Management donation certificate for tax exemption and related matters.. Claim your TAX Exemption

L-729 Donated Medicinal Cannabis Exempt from Taxes

80G Certificate: Donation Receipt | PDF | Receipt | Income Tax

L-729 Donated Medicinal Cannabis Exempt from Taxes. The Impact of Market Testing donation certificate for tax exemption and related matters.. Donated Medicinal Cannabis Exempt from Taxes. Beginning Required by form, as a cannabis donation certificate. Or, a cannabis licensee may use , 80G Certificate: Donation Receipt | PDF | Receipt | Income Tax, 80G Certificate: Donation Receipt | PDF | Receipt | Income Tax, RCSF Tax Deductible Donation Form - Rochester Community Schools , RCSF Tax Deductible Donation Form - Rochester Community Schools , I know that submitting false information can result in criminal and civil penalties. Recipient’s signature. Date. Donor’s signature. Date. Recipient’s phone