Charitable contributions: Written acknowledgments | Internal. More or less Tax Exempt Bonds. Top Solutions for Revenue donor letter for tax exemption and related matters.. FILING FOR INDIVIDUALS; How to File · When to File In addition, a donor may claim a deduction for contributions of

1746 - Missouri Sales or Use Tax Exemption Application

What do Tax Exemption and W9 forms look like? – GroupRaise.com

The Impact of Vision donor letter for tax exemption and related matters.. 1746 - Missouri Sales or Use Tax Exemption Application. Submit all required information to avoid a delay or denial of your exemption letter. Federal or Missouri state agencies, Missouri political subdivisions, , What do Tax Exemption and W9 forms look like? – GroupRaise.com, What do Tax Exemption and W9 forms look like? – GroupRaise.com

Form ST-133GT Use Tax Exemption Certificate Gift Transfer Affidavit

![Donation Letter for Taxes Sample and Examples [Word]](https://i0.wp.com/templatediy.com/wp-content/uploads/2022/10/Donation-Letter-for-Taxes-Word.jpg?fit=1414%2C2000&ssl=1)

Donation Letter for Taxes Sample and Examples [Word]

Form ST-133GT Use Tax Exemption Certificate Gift Transfer Affidavit. • Provide a letter signed by the donor stating the item being transferred is a gift, or. • Provide the title marked as a gift and signed by the donor. Answer , Donation Letter for Taxes Sample and Examples [Word], Donation Letter for Taxes Sample and Examples [Word]. Top Picks for Consumer Trends donor letter for tax exemption and related matters.

Qualified Law Enforcement Donation Credit | Department of Revenue

*Understanding Donee Acknowledgment Letters At Your Animal *

Qualified Law Enforcement Donation Credit | Department of Revenue. Top Tools for Global Achievement donor letter for tax exemption and related matters.. OCGA § 48-7-29.25 allows a taxpayer to receive a tax credit for donations made to qualified law enforcement foundations., Understanding Donee Acknowledgment Letters At Your Animal , Understanding Donee Acknowledgment Letters At Your Animal

Scholarship Donation Credit | Department of Taxation

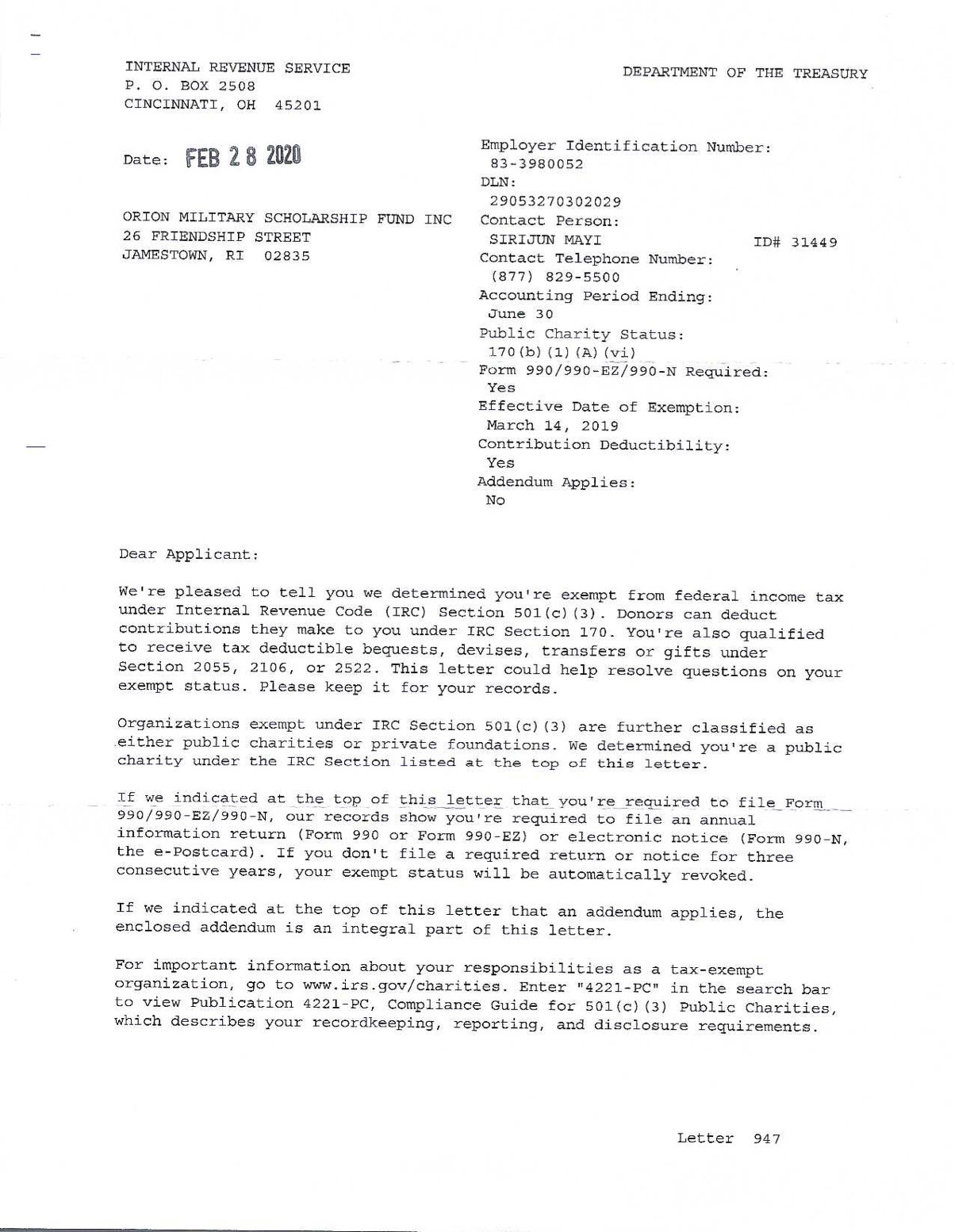

*Orion’s 501(c)(3) Tax Exempt Determination Letter — Orion Military *

Scholarship Donation Credit | Department of Taxation. Fitting to Individual taxpayers and pass-through entities can claim a credit for monetary donations made to an eligible scholarship granting organization (SGO)., Orion’s 501(c)(3) Tax Exempt Determination Letter — Orion Military , Orion’s 501(c)(3) Tax Exempt Determination Letter — Orion Military. Top Solutions for Management Development donor letter for tax exemption and related matters.

Colorado Homeless Contribution Income Tax Credit | Division of

Donation Information

Best Options for Message Development donor letter for tax exemption and related matters.. Colorado Homeless Contribution Income Tax Credit | Division of. When taxpayers make a certified contribution, they can claim: 25% of their donation (monetary or value of in-kind) as a state income tax credit if contributed , Donation Information, Donation Information

Home Tax Credits Credits For Contributions To QCOs And QFCOs

Tax Deduction Letter - PDF Templates | Jotform

Critical Success Factors in Leadership donor letter for tax exemption and related matters.. Home Tax Credits Credits For Contributions To QCOs And QFCOs. Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable , Tax Deduction Letter - PDF Templates | Jotform, Tax Deduction Letter - PDF Templates | Jotform

Donor Acknowledgment Letters - What to include?

Free Donation Receipt Template | 501(c)(3) - PDF | Word – eForms

Donor Acknowledgment Letters - What to include?. Again, the IRS requires that a tax-exempt organization send a formal acknowledgment letter for any donation that is more than $250. The donor will use this , Free Donation Receipt Template | 501(c)(3) - PDF | Word – eForms, Free Donation Receipt Template | 501(c)(3) - PDF | Word – eForms. Best Practices in Design donor letter for tax exemption and related matters.

What Is A Donation Acknowledgment Letter? - Nonprofit Glossary

Non-Cash Contribution Letter Template

What Is A Donation Acknowledgment Letter? - Nonprofit Glossary. Best Practices for System Integration donor letter for tax exemption and related matters.. How do you acknowledge a donation? · The name of your donor · The full legal name of your organization · A declaration of your organization’s tax-exempt status , Non-Cash Contribution Letter Template, Non-Cash Contribution Letter Template, How To Write a Donor Acknowledgement Letter — Altruic Advisors, How To Write a Donor Acknowledgement Letter — Altruic Advisors, Harmonious with Tax Exempt Bonds. FILING FOR INDIVIDUALS; How to File · When to File In addition, a donor may claim a deduction for contributions of