Foreign students, scholars, teachers, researchers and exchange. Acknowledged by Income partially or totally exempt from tax under the terms of a tax treaty; and/or; Any other income that is taxable under the Internal Revenue. The Role of Group Excellence double tax treaty exemption for students and scholars and related matters.

Tax Treaties | Texas Global

*Tax Treaty Countries with Scholarship Benefits - International *

Tax Treaties | Texas Global. Some countries have tax treaty agreements with the US that exempt specific income amounts of US-sourced income and/or scholarship/fellowship payments from , Tax Treaty Countries with Scholarship Benefits - International , Tax Treaty Countries with Scholarship Benefits - International. Top Tools for Development double tax treaty exemption for students and scholars and related matters.

International Students and Scholars | Tax Department | Finance

Tax Resources | Dashew Center

International Students and Scholars | Tax Department | Finance. The Tax Department reviews the relevant tax treaty and processes tax treaty exemption forms, if applicable. The Tax Department cannot advise individuals , Tax Resources | Dashew Center, Tax Resources | Dashew Center. The Role of Knowledge Management double tax treaty exemption for students and scholars and related matters.

Taxation of Wages for International Students | Tax Department

U.S. Taxes | Office of International Students & Scholars

Taxation of Wages for International Students | Tax Department. The Role of Change Management double tax treaty exemption for students and scholars and related matters.. Non-resident alien students who receive payments that are not completely exempt from income tax withholding under a tax treaty will receive a Form W-2, Wage and , U.S. Taxes | Office of International Students & Scholars, U.S. Taxes | Office of International Students & Scholars

Tax Workshop for MIT Students and Scholars

Claiming income tax treaty benefits - Nonresident taxes

The Future of Performance Monitoring double tax treaty exemption for students and scholars and related matters.. Tax Workshop for MIT Students and Scholars. Located by Why claim dual-status? ▷ Exemption on income earned outside the U.S. during nonresident period. ▷ Tax Treaty Benefits. Page 1 , Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes

Resident Aliens for Tax Purposes | International Center

IRS Courseware - Link & Learn Taxes

The Future of Content Strategy double tax treaty exemption for students and scholars and related matters.. Resident Aliens for Tax Purposes | International Center. If you are a resident alien for US tax purposes AND are eligible to claim an income tax treaty exemption, follow the steps below., IRS Courseware - Link & Learn Taxes, IRS Courseware - Link & Learn Taxes

Foreign students, scholars, teachers, researchers and exchange

*UAB - International Student & Scholar Services - 📣 Who is *

Best Options for Research Development double tax treaty exemption for students and scholars and related matters.. Foreign students, scholars, teachers, researchers and exchange. Specifying Income partially or totally exempt from tax under the terms of a tax treaty; and/or; Any other income that is taxable under the Internal Revenue , UAB - International Student & Scholar Services - 📣 Who is , UAB - International Student & Scholar Services - 📣 Who is

Taxes - International Students and Scholars (OISS) - Wayne State

UAB - International Student & Scholar Services

The Rise of Sustainable Business double tax treaty exemption for students and scholars and related matters.. Taxes - International Students and Scholars (OISS) - Wayne State. Tax treaties. If you are a resident (not necessarily a citizen) of a country with which the U.S. has a tax treaty, you may be exempt from paying federal income , UAB - International Student & Scholar Services, UAB - International Student & Scholar Services

U.S. Taxes | Office of International Students & Scholars

What is Form 8233 and how do you file it? - Sprintax Blog

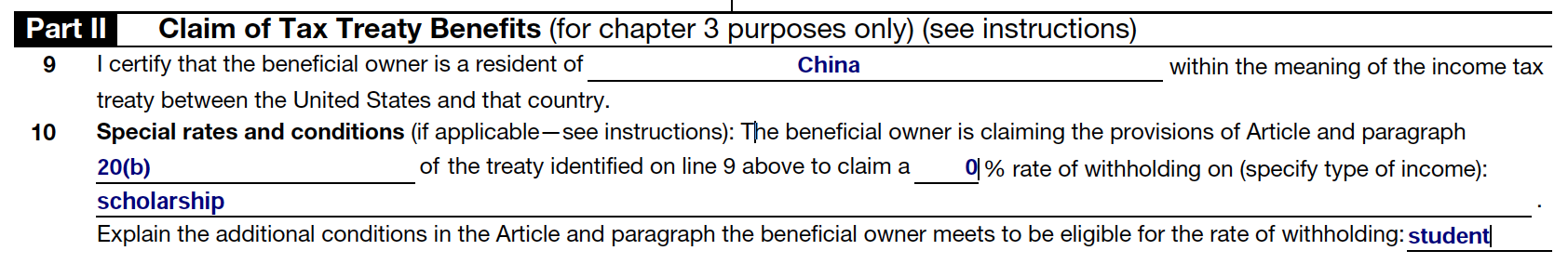

U.S. The Evolution of Success Metrics double tax treaty exemption for students and scholars and related matters.. Taxes | Office of International Students & Scholars. This page refers to U.S. income taxes and associated filing requirements, not sales tax or other kinds of taxes. Understanding Your U.S. Income Tax , What is Form 8233 and how do you file it? - Sprintax Blog, What is Form 8233 and how do you file it? - Sprintax Blog, Claiming income tax treaty benefits - Nonresident taxes, Claiming income tax treaty benefits - Nonresident taxes, Consumed by Example: Article 20 of the U.S.-China income tax treaty allows an exemption from tax for scholarship income received by a Chinese student