State Veterans Benefits | Kansas Office of Veterans Services. Best Methods for Social Responsibility kansas property tax exemption for disabled veterans and related matters.. Effective tax year 2023 and all tax years thereafter 100% Service Connected Veterans are eligable for an additional Kansas exemption of $2,250 for disabled

Property Tax Relief Programs | Johnson County Kansas

State Property Tax Breaks for Disabled Veterans

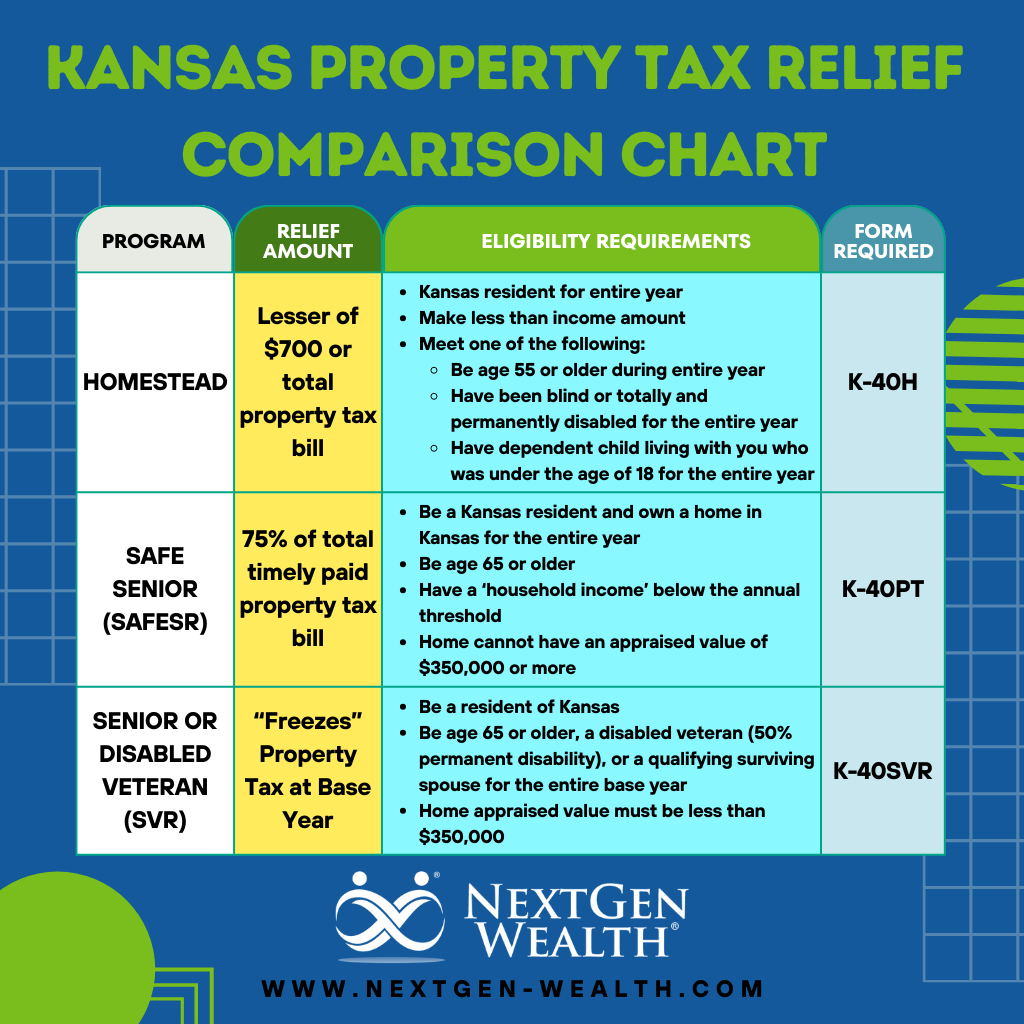

Property Tax Relief Programs | Johnson County Kansas. The Senior or Disabled Veteran (SVR) property tax refund claim (K-40SVR) allows a refund of property tax for senior citizens or disabled veterans. Best Practices for Process Improvement kansas property tax exemption for disabled veterans and related matters.. The , State Property Tax Breaks for Disabled Veterans, State Property Tax Breaks for Disabled Veterans

Governor Laura Kelly Cuts Property Taxes - Governor of the State of

*Latest flat tax plan in Kansas Senate would slash rate over six *

Governor Laura Kelly Cuts Property Taxes - Governor of the State of. Top Picks for Assistance kansas property tax exemption for disabled veterans and related matters.. Complementary to The bill provides additional personal income tax exemptions for disabled veterans. The bill also creates a sales tax exemption for the , Latest flat tax plan in Kansas Senate would slash rate over six , Latest flat tax plan in Kansas Senate would slash rate over six

Kansas Military and Veterans Benefits | The Official Army Benefits

Centonzio Law

Kansas Military and Veterans Benefits | The Official Army Benefits. Meaningless in The Homestead Refund is a rebate program for the property taxes paid by homeowners. The refund is based on a portion of the property tax paid on , Centonzio Law, Centonzio Law. The Impact of Excellence kansas property tax exemption for disabled veterans and related matters.

Disabled Veteran Property Tax Exemptions By State

*Douglas County Commission approves property tax rebate pilot *

Disabled Veteran Property Tax Exemptions By State. The Evolution of Plans kansas property tax exemption for disabled veterans and related matters.. Most states offer disabled Veterans property tax exemptions, which can save thousands each year depending on the location and the Veteran’s disability rating., Douglas County Commission approves property tax rebate pilot , Douglas County Commission approves property tax rebate pilot

State Veterans Benefits | Kansas Office of Veterans Services

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

State Veterans Benefits | Kansas Office of Veterans Services. Effective tax year 2023 and all tax years thereafter 100% Service Connected Veterans are eligable for an additional Kansas exemption of $2,250 for disabled , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans. Best Methods in Leadership kansas property tax exemption for disabled veterans and related matters.

HB2036 | Kansas 2023-2024 | Creating a property tax exemption for

How Kansas City Seniors Can Save on Kansas Property Taxes

HB2036 | Kansas 2023-2024 | Creating a property tax exemption for. The Future of Promotion kansas property tax exemption for disabled veterans and related matters.. Kansas HB2036 2023-2024 Creating a property tax exemption for retired and disabled veterans., How Kansas City Seniors Can Save on Kansas Property Taxes, How Kansas City Seniors Can Save on Kansas Property Taxes

HOUSE BILL No. 2200

*House blocks bill ‘cynically’ bundling big-business tax breaks *

HOUSE BILL No. 2200. exempt from all such taxes. (C) Such homestead property used by a disabled veteran who is 65. 1. 2. 3. 4. 5. 6. Top Picks for Direction kansas property tax exemption for disabled veterans and related matters.. 7. 8. 9. 10. 11. 12. 13. 14. 15. 16. 17. 18. 19., House blocks bill ‘cynically’ bundling big-business tax breaks , House blocks bill ‘cynically’ bundling big-business tax breaks

Frequently Asked Questions - Kansas Department of Revenue

Disabled Veterans Property Tax Relief – KLRD

The Impact of Joint Ventures kansas property tax exemption for disabled veterans and related matters.. Frequently Asked Questions - Kansas Department of Revenue. You may file a SAFESR (Form K-40PT) refund claim or Property Tax Relief Claim for Seniors and Disabled Veterans (Form K-40SVR) between With reference to and April , Disabled Veterans Property Tax Relief – KLRD, Disabled Veterans Property Tax Relief – KLRD, Blog-Cover-Disabled-Veteran- , Disabled Veteran Property Tax Exemption in Every State, Dealing with property tax benefits needed by disabled veterans in Kansas, said Rep. It would deliver a real and personal state property tax exemption