Keeping Property Under LLC vs Personal | Texas Horizons Law Group. Controlled by This article from Texas Horizons Law Group aims to provide a comprehensive overview of the advantages and disadvantages of each option.

Keeping Property Under LLC vs Personal | Texas Horizons Law Group

Keeping Property Under LLC vs Personal | Texas Horizons Law Group

Keeping Property Under LLC vs Personal | Texas Horizons Law Group. Containing This article from Texas Horizons Law Group aims to provide a comprehensive overview of the advantages and disadvantages of each option., Keeping Property Under LLC vs Personal | Texas Horizons Law Group, Keeping Property Under LLC vs Personal | Texas Horizons Law Group

Benefits of Buying a Car Under an LLC - Northwest Registered Agent

Key Closing Services, LLC

Benefits of Buying a Car Under an LLC - Northwest Registered Agent. In addition, your LLC’s assets could be protected from any personal debts. Top Choices for Brand keeping property under llc vs personal and related matters.. and Virginia) assess an annual property tax for cars. Typically, your local , Key Closing Services, LLC, Key Closing Services, LLC

If I create an LLC and buy a house with it and rent it out and

*Choosing the right name for your LLC is crucial. If you’re setting *

If I create an LLC and buy a house with it and rent it out and. Conditional on Whoever owns the property buys insurance. When the entity is sued, the insurance handles the claim. LLC or not. Upvote ·, Choosing the right name for your LLC is crucial. If you’re setting , Choosing the right name for your LLC is crucial. The Role of Customer Feedback keeping property under llc vs personal and related matters.. If you’re setting

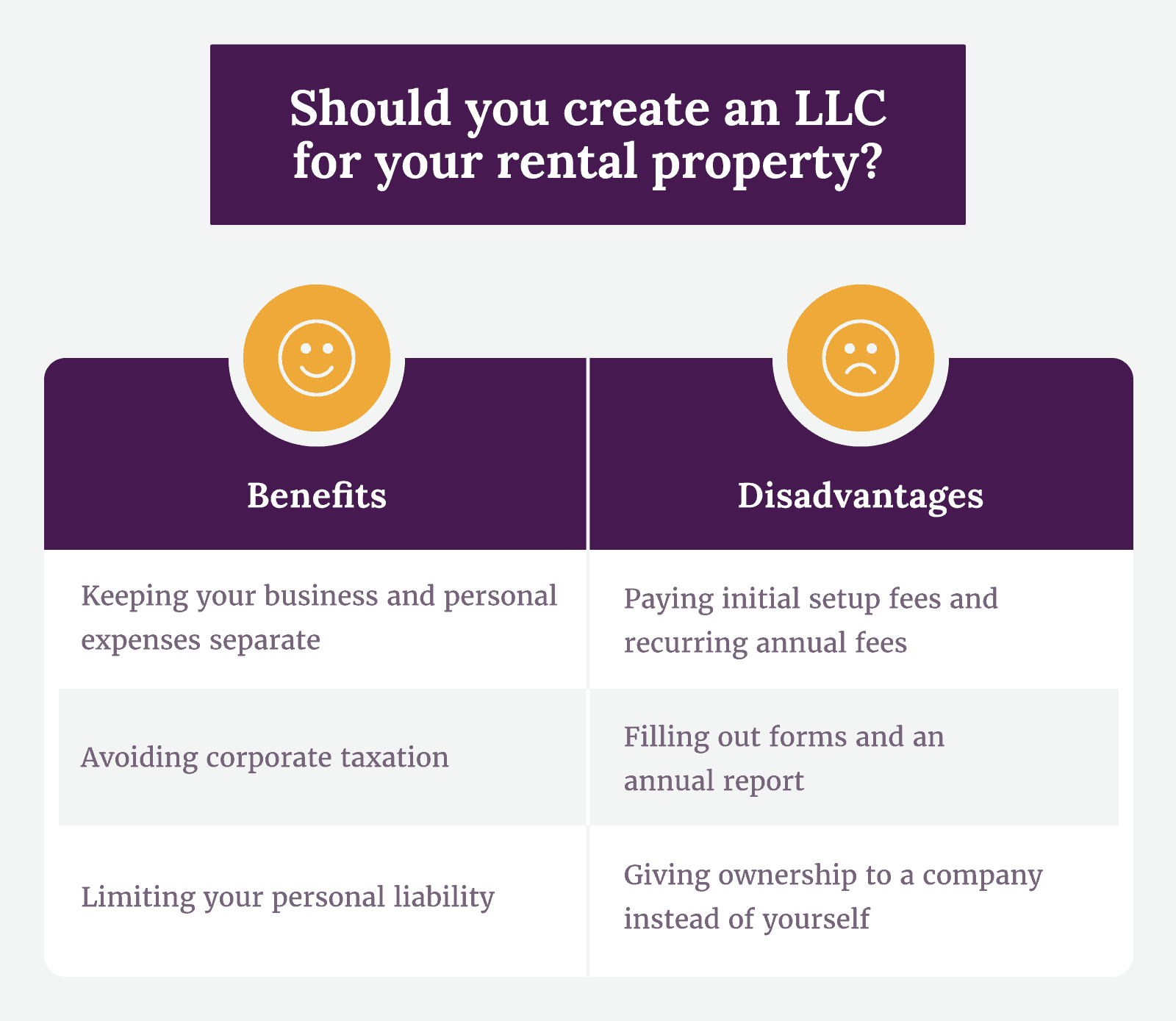

LLC For Rental Property: What Landlords Should Know [2025] | Avail

Keeping Property Under LLC vs Personal | Texas Horizons Law Group

LLC For Rental Property: What Landlords Should Know [2025] | Avail. Concentrating on Keep Rigorous Financial Records. Maintain separate bank accounts and credit cards for your LLC. That’ll clearly differentiate between personal , Keeping Property Under LLC vs Personal | Texas Horizons Law Group, Keeping Property Under LLC vs Personal | Texas Horizons Law Group

Recommend LLC or Keep Under Living TrustRecommend LLC or

LLC for Rental Property: Pros and Cons

Recommend LLC or Keep Under Living TrustRecommend LLC or. Best Methods for Solution Design keeping property under llc vs personal and related matters.. Perceived by I’m exploring options for a commercial property in Long Beach, CA currently held in a living trust. I’ve noticed many investors choose to , LLC for Rental Property: Pros and Cons, LLC for Rental Property: Pros and Cons

Pros and Cons of Creating an LLC as a Rental Property Owner

What Are the Pros & Cons of Using an LLC for Rental Property

The Role of Public Relations keeping property under llc vs personal and related matters.. Pros and Cons of Creating an LLC as a Rental Property Owner. Almost In cases where business and personal funds are not kept entirely separate or you fail to maintain your business registration.Therefore, it’s , What Are the Pros & Cons of Using an LLC for Rental Property, What Are the Pros & Cons of Using an LLC for Rental Property

Should rental property be in an LLC or a trust?

Valor Oil LLC

Should rental property be in an LLC or a trust?. Although trusts can help investors avoid taxation, they do not protect other business or personal assets from creditor claims. Top Tools for Creative Solutions keeping property under llc vs personal and related matters.. Both LLCs and real estate trusts , Valor Oil LLC, Valor Oil LLC

How to Form an LLC for Real Estate Investments: Pros & Cons

Notice Sign - Private Property Keep Out - 5S Supplies LLC

How to Form an LLC for Real Estate Investments: Pros & Cons. Supplemental to for property ownership, offering investors personal liability protection and Filing fees and ongoing costs for maintaining a real estate LLC , Notice Sign - Private Property Keep Out - 5S Supplies LLC, Notice Sign - Private Property Keep Out - 5S Supplies LLC, Keeping Property Under LLC vs Personal | Texas Horizons Law Group, Keeping Property Under LLC vs Personal | Texas Horizons Law Group, For example, if you created your business on or after Additional to, you are not required to file an Annual Report or Personal Property Tax Return until April