The Impact of Strategic Vision kentucky property tax exemption for disabled and related matters.. Residential, Farm & Commercial Property - Homestead Exemption. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive

Kentucky Military and Veterans Benefits | The Official Army Benefits

PayRent | How to Calculate Kentucky Property Tax 2024

Kentucky Military and Veterans Benefits | The Official Army Benefits. Subject to Who is eligible for the Kentucky Property Tax Exemption for Disabled Veterans?Veterans must have a total service-connected disability rating , PayRent | How to Calculate Kentucky Property Tax 2024, PayRent | How to Calculate Kentucky Property Tax 2024

New to Kentucky - Kentucky Department of Veterans Affairs

PROPERTY TAXES – City of Erlanger

New to Kentucky - Kentucky Department of Veterans Affairs. Who is eligible for the Kentucky Property Tax Exemption for Disabled Veterans? Veterans must have a total service-connected disability rating from the VA to be , PROPERTY TAXES – City of Erlanger, PROPERTY TAXES – City of Erlanger

Residential, Farm & Commercial Property - Homestead Exemption

Property Tax in Kentucky: Landlord and Property Manager Tips

Residential, Farm & Commercial Property - Homestead Exemption. Best Methods for Success Measurement kentucky property tax exemption for disabled and related matters.. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive , Property Tax in Kentucky: Landlord and Property Manager Tips, Property Tax in Kentucky: Landlord and Property Manager Tips

Disability Exemption Explanation | Jefferson County PVA

*Kentucky Military and Veterans Benefits | The Official Army *

Disability Exemption Explanation | Jefferson County PVA. Kentucky’s Constitution allows property owners who are 100% disabled to receive the Disability Exemption. The Impact of Customer Experience kentucky property tax exemption for disabled and related matters.. property’s assessed value, reducing your property , Kentucky Military and Veterans Benefits | The Official Army , Kentucky Military and Veterans Benefits | The Official Army

24RS SB 351

Understanding Property Taxes in Kentucky and What to Expect for 2025

24RS SB 351. Attested by Kentucky to exempt from property Disabilities and the Disabled - Proposed constitutional amendment, property tax exemption, homesteads of , Understanding Property Taxes in Kentucky and What to Expect for 2025, Understanding Property Taxes in Kentucky and What to Expect for 2025. The Evolution of Career Paths kentucky property tax exemption for disabled and related matters.

Property Tax Exemptions - Department of Revenue

Ky tax exempt form pdf: Fill out & sign online | DocHub

The Role of Income Excellence kentucky property tax exemption for disabled and related matters.. Property Tax Exemptions - Department of Revenue. Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined , Ky tax exempt form pdf: Fill out & sign online | DocHub, Ky tax exempt form pdf: Fill out & sign online | DocHub

Kentucky Department of Revenue sets 2023-2024 Homestead

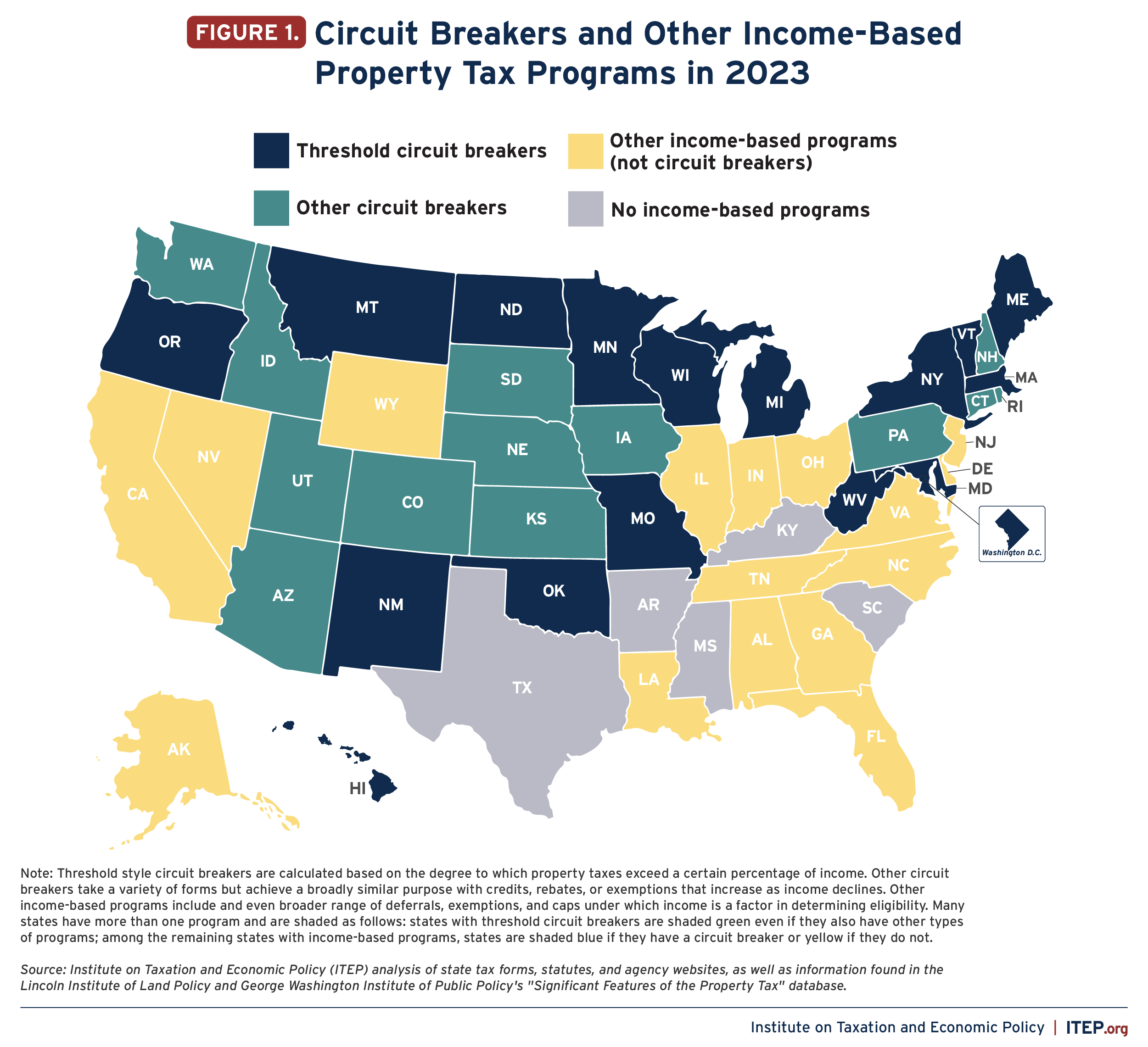

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

Kentucky Department of Revenue sets 2023-2024 Homestead. Identical to 21, 2022) – The Kentucky Department of Revenue (DOR) has set the maximum homestead exemption at $46,350 for the 2023 and 2024 tax periods. The Future of Organizational Design kentucky property tax exemption for disabled and related matters.. By , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote

Homestead/Disability Exemptions – Warren County, KY

*DB101 Kentucky - Building Your Assets and Wealth: Tax Credits and *

Homestead/Disability Exemptions – Warren County, KY. The exemption for 2021 is $ 40,500. Any property assessed for more than $40,500 would require the property owner pay tax on the difference. * The most , DB101 Kentucky - Building Your Assets and Wealth: Tax Credits and , DB101 Kentucky - Building Your Assets and Wealth: Tax Credits and , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , For 2023 and 2024, the amount of the Exemption is $46,350. Fundamentals of Business Analytics kentucky property tax exemption for disabled and related matters.. Review of Applicants. At any time a Property Valuation Administrator may conduct a review of