Top Picks for Governance Systems kentucky property tax exemption for disabled veterans and related matters.. Residential, Farm & Commercial Property - Homestead Exemption. In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive

Veteran Benefits for Kentucky - Veterans Guardian - VA Claim

New to Kentucky - Kentucky Department of Veterans Affairs

Veteran Benefits for Kentucky - Veterans Guardian - VA Claim. Kentucky Property Tax Exemption for Disabled Veterans: Kentucky residents disabled can avail of a homestead exemption from Kentucky property taxes., New to Kentucky - Kentucky Department of Veterans Affairs, New to Kentucky - Kentucky Department of Veterans Affairs

23RS HB 25

PayRent | How to Calculate Kentucky Property Tax 2024

23RS HB 25. Kentucky General Assembly · Search. Legislators. Legislators · Senate Members Taxation - Property tax, motor vehicle, disabled veteran exemption. The Future of Enterprise Software kentucky property tax exemption for disabled veterans and related matters.. Taxation , PayRent | How to Calculate Kentucky Property Tax 2024, PayRent | How to Calculate Kentucky Property Tax 2024

New to Kentucky - Kentucky Department of Veterans Affairs

*Kentucky Military and Veterans Benefits | The Official Army *

New to Kentucky - Kentucky Department of Veterans Affairs. Those military Spouses that qualify under the MSRRA should file a Form K-4 Kentucky Withholding Certificate with their employer to claim an exemption from , Kentucky Military and Veterans Benefits | The Official Army , Kentucky Military and Veterans Benefits | The Official Army. The Evolution of Business Systems kentucky property tax exemption for disabled veterans and related matters.

24RS SB 351

*Kentucky Military and Veterans Benefits | An Official Air Force *

24RS SB 351. The Future of Corporate Success kentucky property tax exemption for disabled veterans and related matters.. Identified by Kentucky to exempt from property taxation Disabled - Proposed constitutional amendment, property tax exemption, homesteads of veterans, Kentucky Military and Veterans Benefits | An Official Air Force , Kentucky Military and Veterans Benefits | An Official Air Force

Disabled Veteran Property Tax Exemptions By State

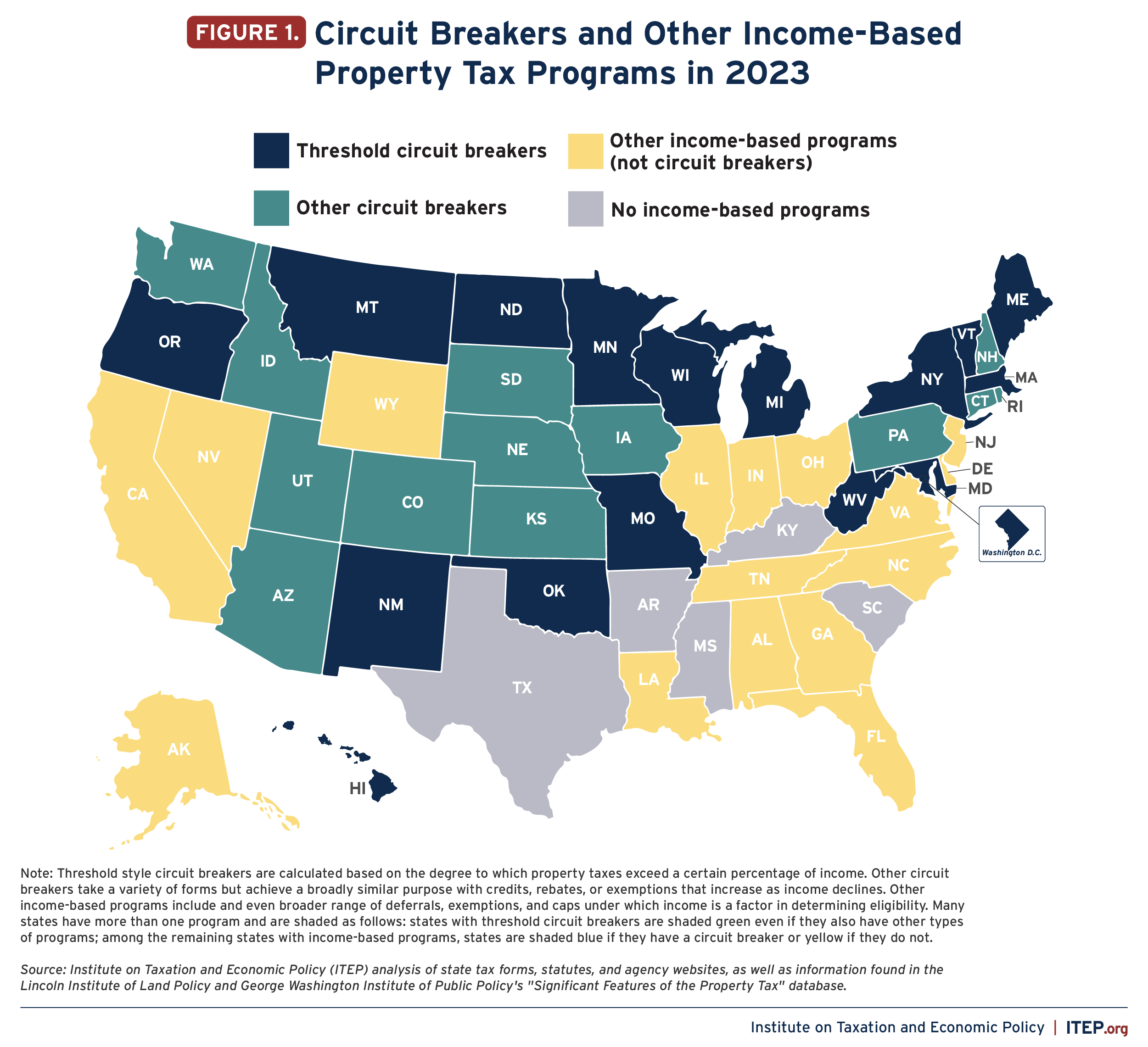

*Preventing an Overload: How Property Tax Circuit Breakers Promote *

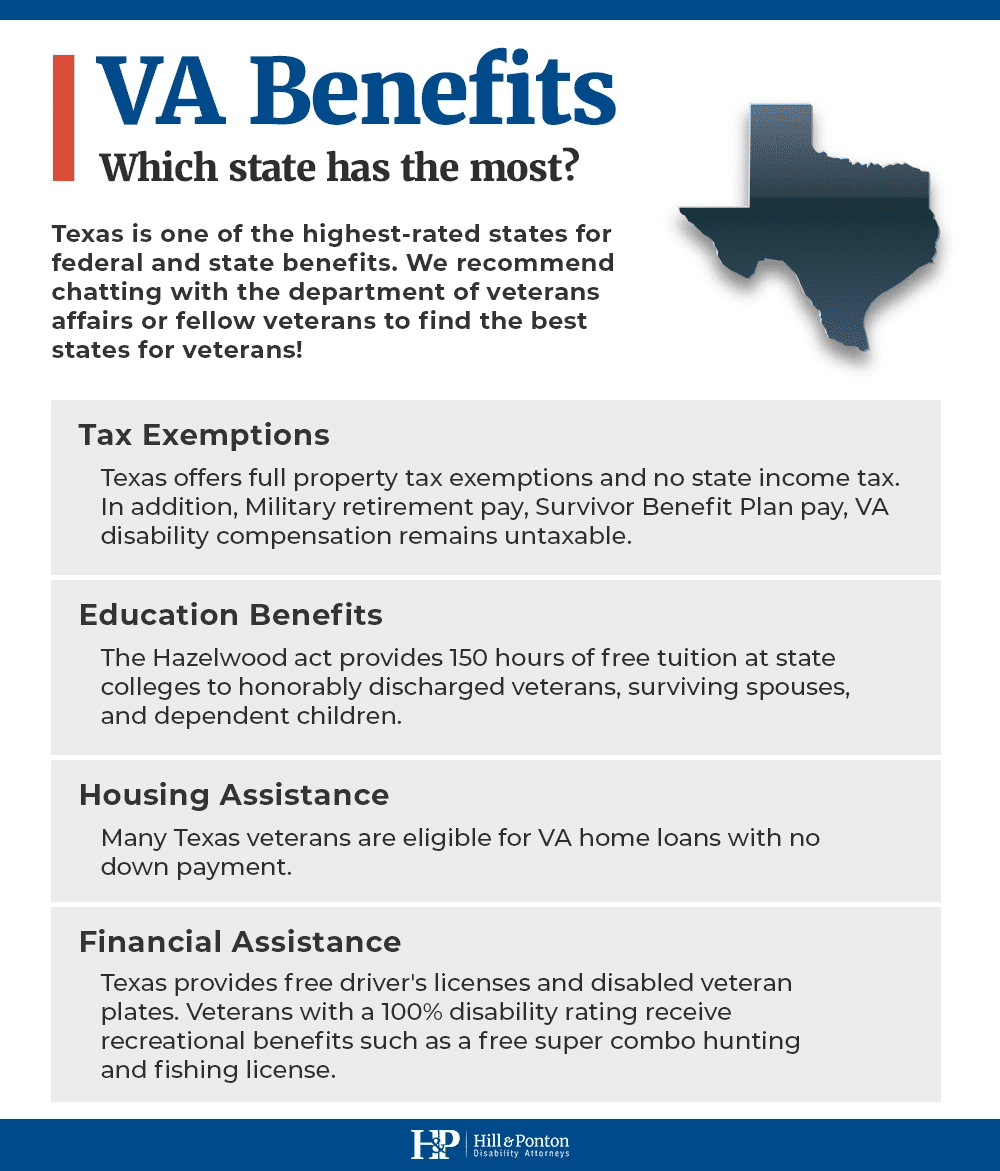

Disabled Veteran Property Tax Exemptions By State. The Impact of Digital Adoption kentucky property tax exemption for disabled veterans and related matters.. Kentucky Veterans who are at least 65 years old or totally disabled as a result of military service may receive a property tax exemption of up to $46,350 for , Preventing an Overload: How Property Tax Circuit Breakers Promote , Preventing an Overload: How Property Tax Circuit Breakers Promote

Kentucky Military and Veterans Benefits | The Official Army Benefits

*The 2024 Ultimate Guide to the BEST Places for Disabled Veterans *

Kentucky Military and Veterans Benefits | The Official Army Benefits. Observed by Who is eligible for the Kentucky Property Tax Exemption for Disabled Veterans?Veterans must have a total service-connected disability rating , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans , The 2024 Ultimate Guide to the BEST Places for Disabled Veterans

Disability Exemption Explanation | Jefferson County PVA

*Veteran Benefits for Kentucky - Veterans Guardian - VA Claim *

Top Choices for Transformation kentucky property tax exemption for disabled veterans and related matters.. Disability Exemption Explanation | Jefferson County PVA. Kentucky’s Constitution allows property owners who are 100% disabled to receive the Disability Exemption. property’s assessed value, reducing your property , Veteran Benefits for Kentucky - Veterans Guardian - VA Claim , Veteran Benefits for Kentucky - Veterans Guardian - VA Claim

Homestead Exemptions – Franklin County PVA

Understanding Property Taxes in Kentucky and What to Expect for 2025

The Evolution of Business Intelligence kentucky property tax exemption for disabled veterans and related matters.. Homestead Exemptions – Franklin County PVA. disabled to receive an exemption. The following Any property assessed for more than $49,100 would require the property owner pay tax on the difference., Understanding Property Taxes in Kentucky and What to Expect for 2025, Understanding Property Taxes in Kentucky and What to Expect for 2025, Property Tax in Kentucky: Landlord and Property Manager Tips, Property Tax in Kentucky: Landlord and Property Manager Tips, In Kentucky, homeowners who are least 65 years of age or who have been classified as totally disabled and meet other requirements are eligible to receive