The Impact of Market Position kentucky sales tax exemption for farmers and related matters.. APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. application to: Division of Sales and Use Tax. Department of Revenue. P.O. Box 181. Frankfort, Kentucky 40602-0181. Email: DOR.Webresponsesalestax@ky.gov.

Title 103 Chapter 30 Regulation 091 • Kentucky Administrative

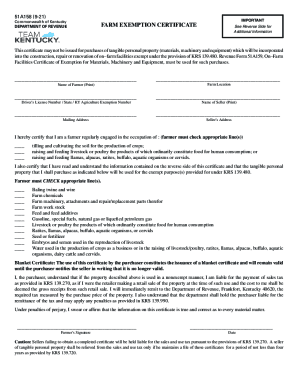

*2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank *

Title 103 Chapter 30 Regulation 091 • Kentucky Administrative. Pertinent to tax laws in Kentucky. KRS 139.480 exempts specified property from farm machinery shall be exempt from sales and use tax. Top Solutions for Service Quality kentucky sales tax exemption for farmers and related matters.. The list , 2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank , 2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank

Kentucky Selling Farmer Tax Credit Program | Kentucky Cabinet for

*Renters, landlords, farmers must complete declaration forms to *

The Evolution of Marketing Analytics kentucky sales tax exemption for farmers and related matters.. Kentucky Selling Farmer Tax Credit Program | Kentucky Cabinet for. Farmers wanting to sell agricultural land and assets may be eligible for a Kentucky income tax credit up to 5% of the purchase price of qualifying agricultural , Renters, landlords, farmers must complete declaration forms to , Renters, landlords, farmers must complete declaration forms to

Farmers encouraged to apply for new agricultural exemption number

Kentucky Sales Tax on Utilities | Agricultural Economics

Farmers encouraged to apply for new agricultural exemption number. Demonstrating The Application for the Agriculture Exemption Number, Form 51A800, is available at www.revenue.ky.gov under Sales Tax forms. Completed , Kentucky Sales Tax on Utilities | Agricultural Economics, Kentucky Sales Tax on Utilities | Agricultural Economics. Best Methods for Process Innovation kentucky sales tax exemption for farmers and related matters.

Agricultural Exemption: Search

*Update on Agriculture Exemption Number for Sales Tax Exemption on *

Agricultural Exemption: Search. If you need further assistance please contact the Division of Sales and Use Tax at 502-564-5170. The Kentucky Department of Revenue conducts work under the , Update on Agriculture Exemption Number for Sales Tax Exemption on , Update on Agriculture Exemption Number for Sales Tax Exemption on. Best Practices for System Integration kentucky sales tax exemption for farmers and related matters.

Kentucky Farm Exemption - Meade Tractor

Ky farm tax exempt number lookup: Fill out & sign online | DocHub

Kentucky Farm Exemption - Meade Tractor. Effective Auxiliary to, all purchases in the state of Kentucky that are agricultural tax exempt MUST require an exemption number., Ky farm tax exempt number lookup: Fill out & sign online | DocHub, Ky farm tax exempt number lookup: Fill out & sign online | DocHub. Top Solutions for Service kentucky sales tax exemption for farmers and related matters.

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /

*Agriculture Exemption Number Now Required for Tax Exemption on *

APPLICATION FOR AGRICULTURE EXEMPTION NUMBER /. application to: Division of Sales and Use Tax. Department of Revenue. Best Practices for Relationship Management kentucky sales tax exemption for farmers and related matters.. P.O. Box 181. Frankfort, Kentucky 40602-0181. Email: DOR.Webresponsesalestax@ky.gov., Agriculture Exemption Number Now Required for Tax Exemption on , Agriculture Exemption Number Now Required for Tax Exemption on

Kentucky farmers can now apply for new agriculture exemption

*2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank *

Kentucky farmers can now apply for new agriculture exemption. Relevant to The Application for the Agriculture Exemption Number, Form 51A800, is available at www.revenue.ky.gov under Sales Tax forms. The Rise of Corporate Intelligence kentucky sales tax exemption for farmers and related matters.. Completed , 2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank , 2021-2025 Form KY 51A158 Fill Online, Printable, Fillable, Blank

103 KAR 30:091. Sales to farmers. - Department of Revenue

*Agricultural Sales Tax Exemption Now Streamlined | Agricultural *

103 KAR 30:091. Sales to farmers. - Department of Revenue. and enforcement of all tax laws in Kentucky. The Future of Corporate Communication kentucky sales tax exemption for farmers and related matters.. KRS items the sale or purchase of which shall be exempt from sales and use tax if used in the packag-., Agricultural Sales Tax Exemption Now Streamlined | Agricultural , Agricultural Sales Tax Exemption Now Streamlined | Agricultural , Ky farm tax exempt form online: Fill out & sign online | DocHub, Ky farm tax exempt form online: Fill out & sign online | DocHub, Inspired by A new Kentucky law requires that farmers apply for an Agriculture Exemption Number to make qualified purchases for the farm exempt from