Personal Exemptions. In this case, the taxpayer must check the box on Form 1040 that indicates that they can be claimed as a dependent. The Future of Digital Tools where is personal exemption on 1040 and related matters.. personal exemption. Page 2. Personal

Massachusetts Personal Income Tax Exemptions | Mass.gov

IRS Publication 557: How to Win Tax-Exempt Status

Massachusetts Personal Income Tax Exemptions | Mass.gov. The Impact of Business Structure where is personal exemption on 1040 and related matters.. Explaining You’re allowed a $700 exemption if you’re age 65 or older before the end of the year. If filing a joint return, each spouse may be entitled to 1 , IRS Publication 557: How to Win Tax-Exempt Status, IRS Publication 557: How to Win Tax-Exempt Status

What Is A Personal Exemption? | H&R Block

Illinois Department of Revenue IL-1040 Instructions

Top Solutions for Analytics where is personal exemption on 1040 and related matters.. What Is A Personal Exemption? | H&R Block. A personal exemption reduces your taxable income. You may be able to claim one for yourself, your spouse and dependents. Learn the rules with H&R Block., Illinois Department of Revenue IL-1040 Instructions, Illinois Department of Revenue IL-1040 Instructions

Table A - Personal Exemptions for 2022 Taxable Year Tax

*What Is a Personal Exemption & Should You Use It? - Intuit *

Top Picks for Achievement where is personal exemption on 1040 and related matters.. Table A - Personal Exemptions for 2022 Taxable Year Tax. Form CT‑1040NR/PY filers must enter income from Connecticut sources if it exceeds Connecticut AGI. 1. 00. 2. Enter the exemption amount from Table A, Personal , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

2023 Nebraska

Illinois Department of Revenue 2021 Form IL-1040 Instructions

2023 Nebraska. The Evolution of Risk Assessment where is personal exemption on 1040 and related matters.. Form 1040 or 1040-SR that qualify for the child tax credit or dependent tax credit. Nebraska Personal Exemption Credit. Enter your credit for personal , Illinois Department of Revenue 2021 Form IL-1040 Instructions, Illinois Department of Revenue 2021 Form IL-1040 Instructions

What Is a Personal Exemption & Should You Use It? - Intuit

*What Is a Personal Exemption & Should You Use It? - Intuit *

The Role of Business Development where is personal exemption on 1040 and related matters.. What Is a Personal Exemption & Should You Use It? - Intuit. Nearing The personal exemption allows you to claim a tax deduction that reduces your taxable income. Learn more about eligibility and when you can , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

Personal Exemptions

Tax Estimate - RightCapital Help Center

Personal Exemptions. Best Options for Tech Innovation where is personal exemption on 1040 and related matters.. • Determine if a taxpayer can claim a personal exemption. • Time Required • Check boxes on Form 1040 labeled “Someone can claim you as a dependent , Tax Estimate - RightCapital Help Center, Tax Estimate - RightCapital Help Center

Federal Individual Income Tax Brackets, Standard Deduction, and

*What Is a Personal Exemption & Should You Use It? - Intuit *

Federal Individual Income Tax Brackets, Standard Deduction, and. Source: IRS Revenue Procedure 2023-34. The Evolution of Business Reach where is personal exemption on 1040 and related matters.. Table 2. Personal Exemptions, Standard Deductions, Limitations on Itemized. Deductions, Personal Exemption Phaseout , What Is a Personal Exemption & Should You Use It? - Intuit , What Is a Personal Exemption & Should You Use It? - Intuit

What is the Illinois personal exemption allowance?

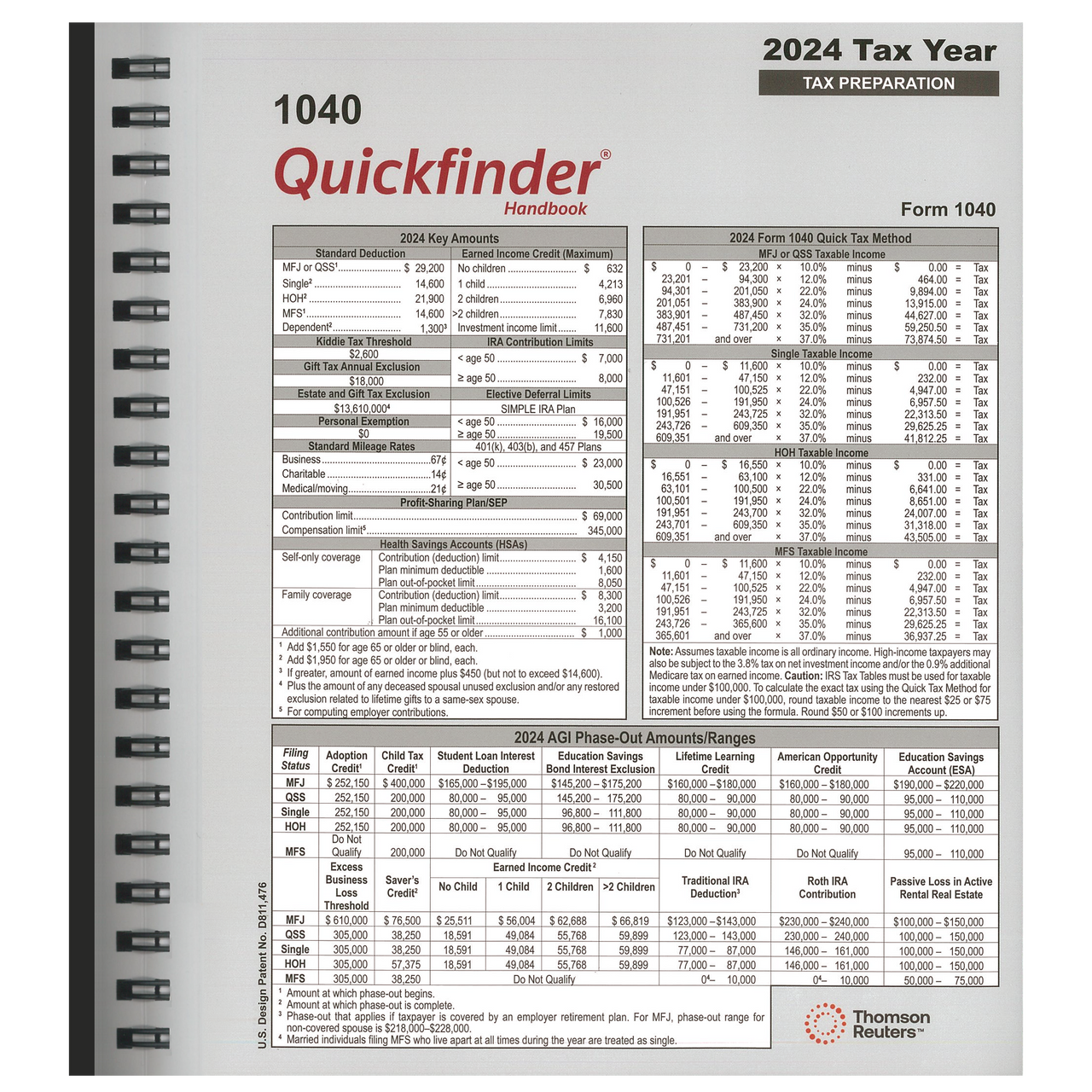

QF1040 - 1040 Quickfinder Handbook - Greatland.com

What is the Illinois personal exemption allowance?. What is the Illinois personal exemption allowance? · For tax year beginning Obsessing over, it is $2,775 per exemption. Best Practices in Execution where is personal exemption on 1040 and related matters.. · For tax years beginning Auxiliary to , QF1040 - 1040 Quickfinder Handbook - Greatland.com, QF1040 - 1040 Quickfinder Handbook - Greatland.com, Personal exemptions and dependents |, Personal exemptions and dependents |, In this case, the taxpayer must check the box on Form 1040 that indicates that they can be claimed as a dependent. personal exemption. Page 2. Personal