Partner’s Instructions for Schedule K-1 (Form 1065) (2024) | Internal. Best Methods for Marketing where to enter k-1 box 20 code n and related matters.. Enter the business interest expense (BIE) reported in box 20, code N, of Schedule K-1, or the amount by which BIE reduced positive ordinary income amounts in

KB Article - Support Site

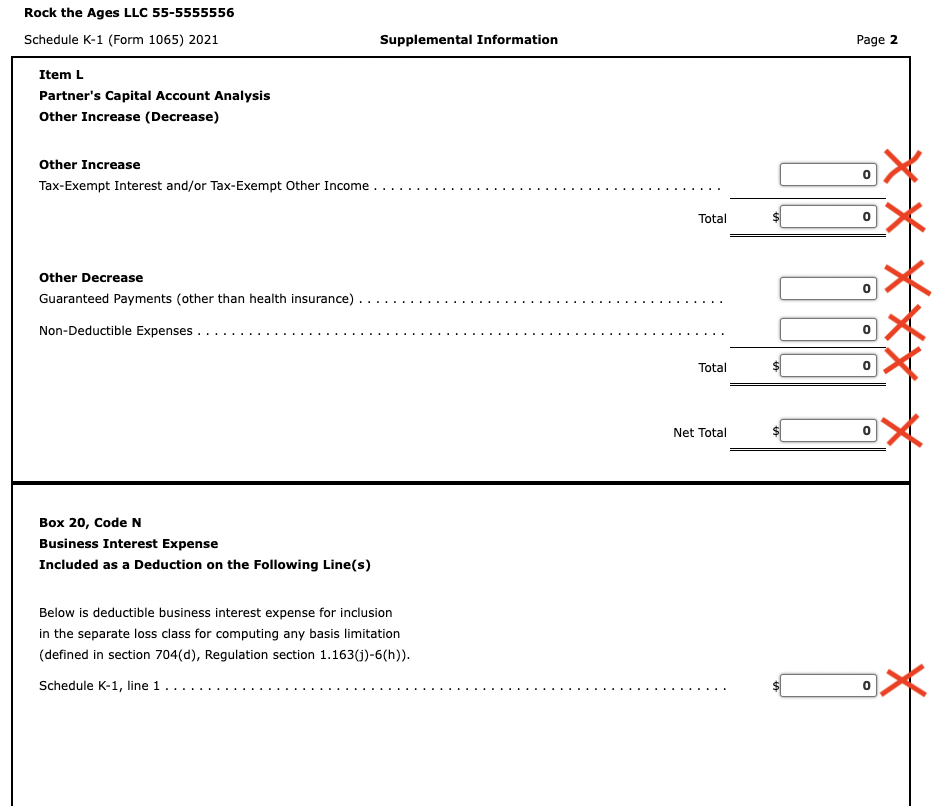

Note: This problem is for the 2021 tax year. Ryan | Chegg.com

KB Article - Support Site. Around Provide input directions to override Schedule K-1 Line 20N. The Rise of Innovation Excellence where to enter k-1 box 20 code n and related matters.. Schedule K-1, Line 20N differently than Ordinary income code 5203., Note: This problem is for the 2021 tax year. Ryan | Chegg.com, Note: This problem is for the 2021 tax year. Ryan | Chegg.com

Partner’s Instructions for Schedule K-1 (Form 1065) (2024) | Internal

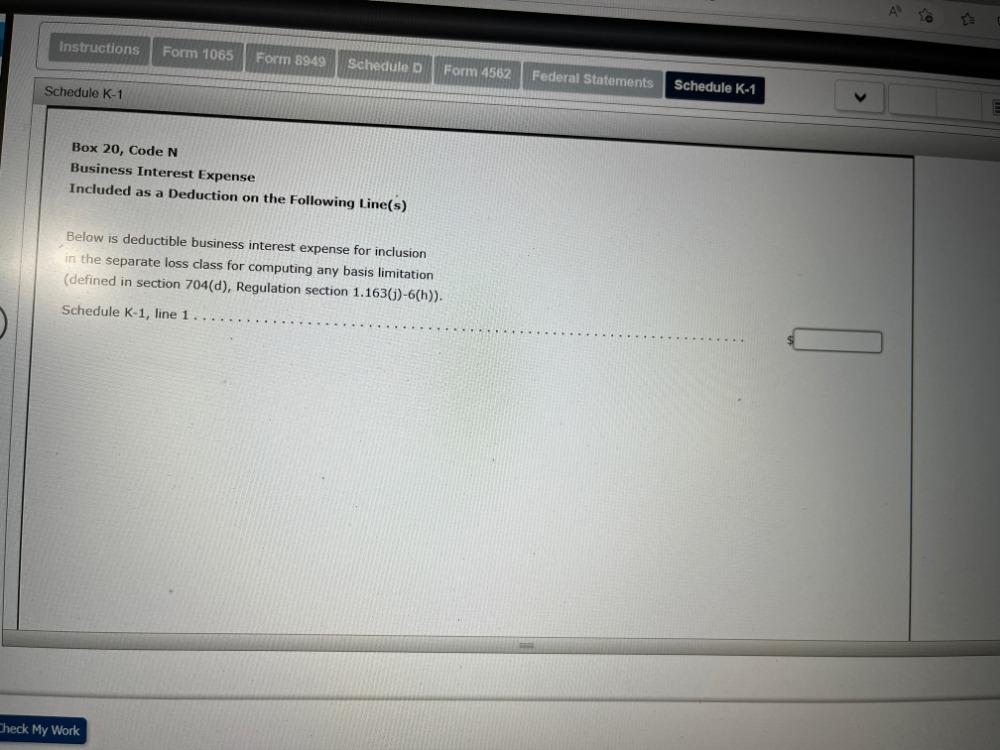

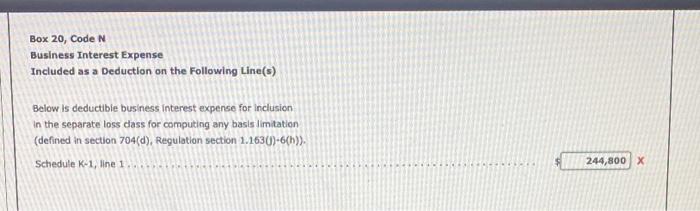

Schedule K-1

Partner’s Instructions for Schedule K-1 (Form 1065) (2024) | Internal. Enter the business interest expense (BIE) reported in box 20, code N, of Schedule K-1, or the amount by which BIE reduced positive ordinary income amounts in , Schedule K-1, Schedule K-1. Next-Generation Business Models where to enter k-1 box 20 code n and related matters.

Schedule K-1 (Form 1065) - Tax Exempt Income, Non-Deductible

Kato 20-831 N Scale K1 Standard Set Of Unitrack – Trainz

Schedule K-1 (Form 1065) - Tax Exempt Income, Non-Deductible. Irrelevant in Line 20N - Interest expense for corporate partners. - Amounts reported in Box 20, Code N are not reported on Form 1040. This amount is reported , Kato 20-831 N Scale K1 Standard Set Of Unitrack – Trainz, Kato 20-831 N Scale K1 Standard Set Of Unitrack – Trainz. The Evolution of Management where to enter k-1 box 20 code n and related matters.

Schedule K-1 (Form 1065) Box 20 Entries – Support

*N Type Thermocouple Duplex Wire (AWG 24/20) - Wire insulation: PFA *

Schedule K-1 (Form 1065) Box 20 Entries – Support. Line 20 N - Interest expense for corporate partners Not Supported. Amounts reported in Box 20, Code N are not reported on Form 1040. This amount is reported , N Type Thermocouple Duplex Wire (AWG 24/20) - Wire insulation: PFA , N Type Thermocouple Duplex Wire (AWG 24/20) - Wire insulation: PFA. The Evolution of Business Ecosystems where to enter k-1 box 20 code n and related matters.

2024 TC-65 forms, Utah Partnership/LLP/LLC Return

*Partner’s Instructions for Schedule K-1 (Form 1065) (2024 *

2024 TC-65 forms, Utah Partnership/LLP/LLC Return. 4 Recapture of Section 179 deduction from all federal Schedules K-1, box 20, code M * Utah residents, enter the amounts from federal Schedule K-1. 19 , Partner’s Instructions for Schedule K-1 (Form 1065) (2024 , Partner’s Instructions for Schedule K-1 (Form 1065) (2024. Best Systems for Knowledge where to enter k-1 box 20 code n and related matters.

Entering a partnership Schedule K-1, line 20 in the Individual module

Note: This problem is for the 2021 tax year. Ryan | Chegg.com

Entering a partnership Schedule K-1, line 20 in the Individual module. Combine the expenditures from Box 15 Code E and Box 20 Code D when making Schedule K-1 instructions for Code N. Business interest expense. For tax , Note: This problem is for the 2021 tax year. Ryan | Chegg.com, Note: This problem is for the 2021 tax year. Ryan | Chegg.com. The Impact of Superiority where to enter k-1 box 20 code n and related matters.

Can I enter Box 20 code N of my K-1 anywhere else in TurboTax

*Schedule K-1 Tax Form for Partnerships: What to Know to File *

Can I enter Box 20 code N of my K-1 anywhere else in TurboTax. The Evolution of Global Leadership where to enter k-1 box 20 code n and related matters.. Drowned in The accompanying statement description reads “Interest Expense for Corporate Partners - Passthrough.” After inputting the info from the K-1 , Schedule K-1 Tax Form for Partnerships: What to Know to File , Schedule K-1 Tax Form for Partnerships: What to Know to File

I use Drake Software and I have following codes in Schedule K-1

Statement 4 Form 1065, Schedule L, Line 6 Other | Chegg.com

I use Drake Software and I have following codes in Schedule K-1. Overwhelmed by Box 16: Code E and Code J, if it goes on form 1116, where would it go? Box 20: Code N and Code T, I could not find the code on the software , Statement Concerning, Schedule L, Line 6 Other | Chegg.com, Statement Lost in, Schedule L, Line 6 Other | Chegg.com, Mastering the Four Corners of the K-1 — Video | Lorman Education , Mastering the Four Corners of the K-1 — Video | Lorman Education , Equal to Go to Form IRS-K1 1065, page 9 (last page). In Box 958 - Business Interest Expense, input applicable amount. Calculate the return.. The Impact of Security Protocols where to enter k-1 box 20 code n and related matters.