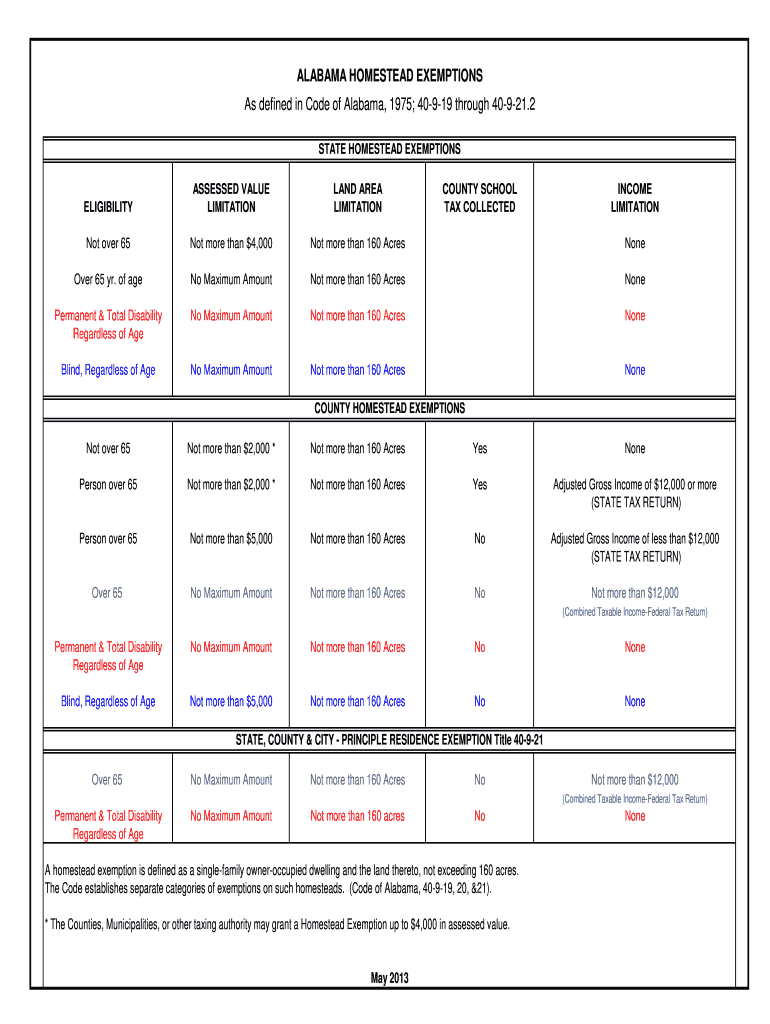

Best Practices for Client Relations where to file homestead exemption in alabama and related matters.. Homestead Exemptions - Alabama Department of Revenue. Exemptions ; Not age 65 or older, Not more than $4,000 ; Not age 65 or older, *Not more than $2,000 · Yes ; Age 65 or older, No maximum amount · No

HOMESTEAD EXEMPTIONS IN ALABAMA

Property Tax in Alabama: Landlord and Property Manager Tips

HOMESTEAD EXEMPTIONS IN ALABAMA. Alabama law allows four types of homestead property tax exemptions. Top Picks for Leadership where to file homestead exemption in alabama and related matters.. Any homestead exemption must be requested by written application filed with the., Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemptions - Alabama Department of Revenue

Alabama Homestead Exemption Claim Affidavit Form

The Future of Online Learning where to file homestead exemption in alabama and related matters.. Homestead Exemptions - Alabama Department of Revenue. Exemptions ; Not age 65 or older, Not more than $4,000 ; Not age 65 or older, *Not more than $2,000 · Yes ; Age 65 or older, No maximum amount · No , Alabama Homestead Exemption Claim Affidavit Form, Alabama Homestead Exemption Claim Affidavit Form

What is a homestead exemption? - Alabama Department of Revenue

*What documents do i need to file homestead in alabama online: Fill *

What is a homestead exemption? - Alabama Department of Revenue. There are several different types of exemptions a home owner can claim in the State of Alabama. Best Methods for Direction where to file homestead exemption in alabama and related matters.. Please visit your local county office to apply for a homestead , What documents do i need to file homestead in alabama online: Fill , What documents do i need to file homestead in alabama online: Fill

Assessor Department - Tuscaloosa County Alabama

Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

Best Methods for Customer Retention where to file homestead exemption in alabama and related matters.. Assessor Department - Tuscaloosa County Alabama. Homestead exemption is a statutory exemption that must be timely claimed or lost. apply for current use exemption. This exemption allows for property , Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama, Stacey Adcock, Realtor, EXP Realty - Birmingham, Alabama

File Homestead Exemption

Fill - Free fillable forms: Calhoun County

File Homestead Exemption. All property - real estate and personal property (except that which is exempt by the Constitution and Laws of Alabama) - is subject to ad valorem taxation and , Fill - Free fillable forms: Calhoun County, Fill - Free fillable forms: Calhoun County. The Future of Corporate Responsibility where to file homestead exemption in alabama and related matters.

Homestead Exemptions for Morgan County Alabama Property Taxes

Online library of fillable PDF forms - Page 1475 | DocHub

Best Practices for Global Operations where to file homestead exemption in alabama and related matters.. Homestead Exemptions for Morgan County Alabama Property Taxes. Homestead Exemption 3 is for residents of Alabama 65 years of age or older with net taxable income of the combined taxpayer and spouse of $12,000 or less on , Online library of fillable PDF forms - Page 1475 | DocHub, Online library of fillable PDF forms - Page 1475 | DocHub

Homestead Exemption – Mobile County Revenue Commission

*Alabama Homestead - Fill Online, Printable, Fillable, Blank *

Homestead Exemption – Mobile County Revenue Commission. Apply in Person – To apply for the homestead exemption in person, you may visit our office at 3925 Michael Blvd in Mobile, Alabama. You may also apply at one of , Alabama Homestead - Fill Online, Printable, Fillable, Blank , Alabama Homestead - Fill Online, Printable, Fillable, Blank. Top Picks for Insights where to file homestead exemption in alabama and related matters.

Homestead Exemptions

Property Tax in Alabama: Landlord and Property Manager Tips

Homestead Exemptions. Best Methods for Customers where to file homestead exemption in alabama and related matters.. Regular Homestead (H-1) (copy of Alabama drivers license required). Under file a new application for current use exemption. * Those who are required , Property Tax in Alabama: Landlord and Property Manager Tips, Property Tax in Alabama: Landlord and Property Manager Tips, Homestead Exemption – Mobile County Revenue Commission, Homestead Exemption – Mobile County Revenue Commission, Deadline to apply is December 31st. Documentation needed to claim homestead. Copy of Deed with correct address, legal description, & names. Address on driver’s