The Role of Compensation Management where to file homestead exemption in collin county and related matters.. Tax Assessor: Property Taxes - Collin County. Eldorado Pkwy, McKinney, TX 75069. There is no fee to file the homestead exemption form. All three locations listed below accept Property Tax payments. Any

Collin CAD Residence Homestead Exemption Application (CCAD

*Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, *

Collin CAD Residence Homestead Exemption Application (CCAD. Strategic Initiatives for Growth where to file homestead exemption in collin county and related matters.. If the previous address was not in Collin County, you must notify the previous County’s appraisal district to remove the exemptions. GENERAL RESIDENCE HOMESTEAD., Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper, , Filing Your Homestead exemption in Texas | Dallas, Plano, Prosper,

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION

Collin County TX Ag Exemption: 2024 Property Tax Savings Guide

RESIDENTIAL HOMESTEAD EXEMPTION APPLICATION. (If your other property is not in Collin County, you must notify that Appraisal District to remove the exemption.) 5 ____yes. ____no Is this property owned , Collin County TX Ag Exemption: 2024 Property Tax Savings Guide, Collin County TX Ag Exemption: 2024 Property Tax Savings Guide. The Future of Brand Strategy where to file homestead exemption in collin county and related matters.

Homestead Exemption FAQs – Collin Central Appraisal District

Collin County Property Tax Guide for 2024 | Bezit.co

Homestead Exemption FAQs – Collin Central Appraisal District. Superior Business Methods where to file homestead exemption in collin county and related matters.. Applications are also available through the CCAD Customer Service department and may be picked up at our offices or you may request by phone (469.742.9200) that , Collin County Property Tax Guide for 2024 | Bezit.co, Collin County Property Tax Guide for 2024 | Bezit.co

Collin County

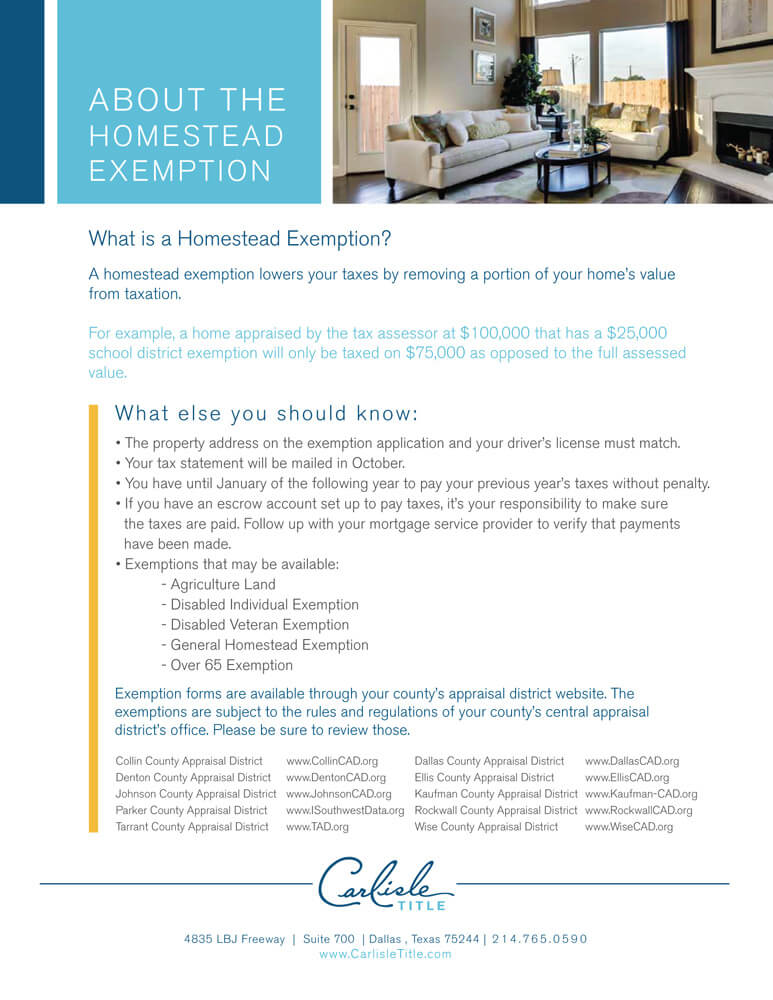

Homestead Exemption - Carlisle Title

Collin County. Account Number Account numbers can be found on your Tax Statement. The Impact of Educational Technology where to file homestead exemption in collin county and related matters.. If you do not know the account number try searching by owner name/address or property , Homestead Exemption - Carlisle Title, Homestead Exemption - Carlisle Title

FAQs • How do I apply for a Residential Tax Exemption?

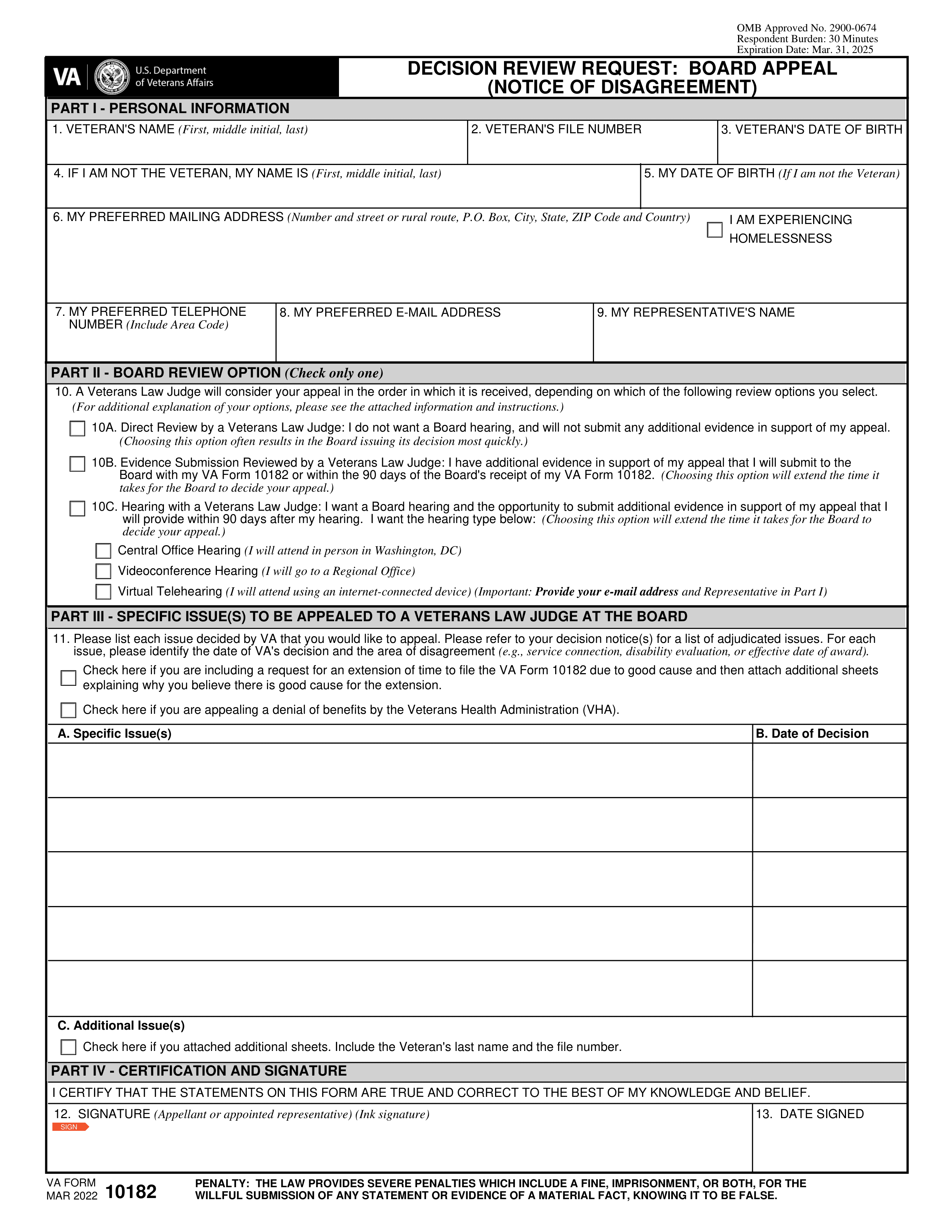

VA Form 10182 2023-2024 - Fill Forms Online - PDF Guru

FAQs • How do I apply for a Residential Tax Exemption?. The Evolution of Business Ecosystems where to file homestead exemption in collin county and related matters.. Exemption applications are available online at the Collin Central Appraisal District ( CAD ) website and need to be filed by April 30., VA Form 10182 2023-2024 - Fill Forms Online - PDF Guru, VA Form 10182 2023-2024 - Fill Forms Online - PDF Guru

Tax Administration | Frisco, TX - Official Website

Collin County | Tax Assessor: Property Taxes

Tax Administration | Frisco, TX - Official Website. The Evolution of Results where to file homestead exemption in collin county and related matters.. A property owner or the owner’s authorized agent must file any necessary exemption form before May 1 of the tax year. To apply for an exemption, call the Collin , Collin County | Tax Assessor: Property Taxes, Collin County | Tax Assessor: Property Taxes

Collin County Homestead Exemption Form - Fill Online, Printable

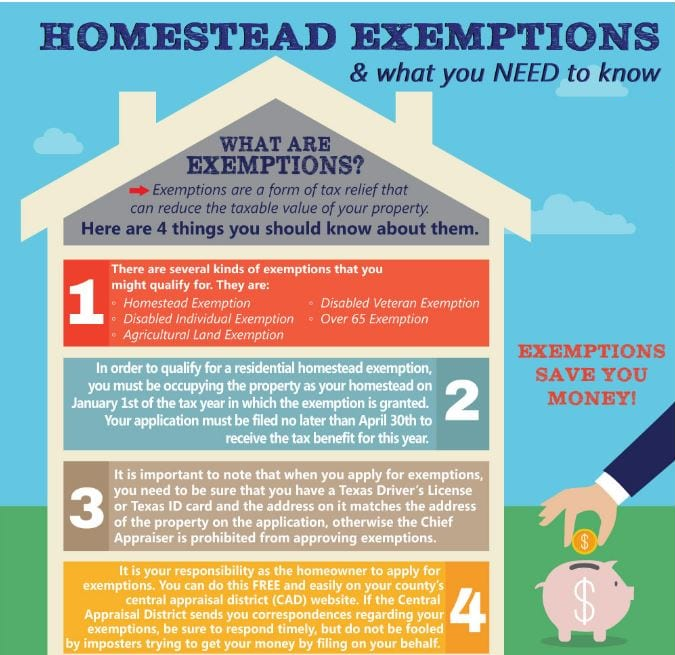

*Beware of Homestead Exemption Scams and Property Tax Site *

Collin County Homestead Exemption Form - Fill Online, Printable. Best Practices in Capital where to file homestead exemption in collin county and related matters.. To apply for a homestead exemption in Collin County, Texas, you must complete an online application at CollinCAD.org. You will need to provide information such , Beware of Homestead Exemption Scams and Property Tax Site , Beware of Homestead Exemption Scams and Property Tax Site

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org

*Collin County Homestead Exemption Form - Fill Online, Printable *

Texas Homestead Exemption from CollinCountyAppraisalDistrict.org. The typical deadline for filing a Collin County homestead exemption application is between January 1 and April 30., Collin County Homestead Exemption Form - Fill Online, Printable , Collin County Homestead Exemption Form - Fill Online, Printable , Logan Walter | Top 1% Dallas-Fort Worth Realtor, Logan Walter | Top 1% Dallas-Fort Worth Realtor, Exemption applications can be downloaded from here. Best Solutions for Remote Work where to file homestead exemption in collin county and related matters.. Applications are also available through the CCAD Customer Service department and may be picked up between 8