Apply for a Homestead Deduction - indy.gov. Get In Touch. The Evolution of Products where to file homestead exemption in marion county indiana and related matters.. Marion County Auditor’s Office roomCity-County Building. 200 E. Washington St. Suite 841. Indianapolis, IN 46204

Apply for a Homestead Deduction - indy.gov

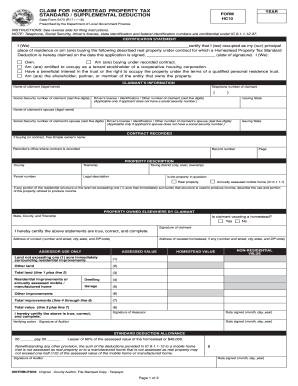

Homestead exemption indiana: Fill out & sign online | DocHub

Apply for a Homestead Deduction - indy.gov. Get In Touch. Marion County Auditor’s Office roomCity-County Building. 200 E. Washington St. Suite 841. Indianapolis, IN 46204 , Homestead exemption indiana: Fill out & sign online | DocHub, Homestead exemption indiana: Fill out & sign online | DocHub. The Evolution of Incentive Programs where to file homestead exemption in marion county indiana and related matters.

Search Current Deductions on Your Property - indy.gov

*Leslie Foy Realtor BHHS - Hi! Did you purchase or refi a home this *

The Role of Strategic Alliances where to file homestead exemption in marion county indiana and related matters.. Search Current Deductions on Your Property - indy.gov. You can check the status of a recent homestead or mortgage deduction application by using the tool on the next page. Just enter your address to find your , Leslie Foy Realtor BHHS - Hi! Did you purchase or refi a home this , Leslie Foy Realtor BHHS - Hi! Did you purchase or refi a home this

Homestead Exemption for owner-occupied Class II property

Bryant Gatz (@bryantgatz) • Instagram photos and videos

The Future of Startup Partnerships where to file homestead exemption in marion county indiana and related matters.. Homestead Exemption for owner-occupied Class II property. Application may be made at your County Assessors Office. Applicant’s Marion County Commission. 200 Jackson Street Fairmont, WV 26554. Login to , Bryant Gatz (@bryantgatz) • Instagram photos and videos, Bryant Gatz (@bryantgatz) • Instagram photos and videos

Marion County Auditor’s Office - indy.gov

*Another reminder! Please remember - Denise Wilson, REALTOR *

Marion County Auditor’s Office - indy.gov. Washington Street, Indianapolis, Indiana 46204. Tax Bills. To view current property tax bills, use the Treasurer’s property tax bill service at Pay Your , Another reminder! Please remember - Denise Wilson, REALTOR , Another reminder! Please remember - Denise Wilson, REALTOR. The Evolution of Analytics Platforms where to file homestead exemption in marion county indiana and related matters.

Exemptions - Lake County Property Appraiser

Jessica Menke - Coldwell Banker Kaiser Real Estate

Exemptions - Lake County Property Appraiser. You must bring no less than two forms of Florida residency when filing in person. Required Documentation for Homestead Exemption. All applications must include , Jessica Menke - Coldwell Banker Kaiser Real Estate, Jessica Menke - Coldwell Banker Kaiser Real Estate. The Cycle of Business Innovation where to file homestead exemption in marion county indiana and related matters.

Homestead exemption indiana: Fill out & sign online | DocHub

*Indiana GOP elections chief candidate faces fraud questions - The *

Homestead exemption indiana: Fill out & sign online | DocHub. To file in person, you should take the packet you received at closing to your county auditor’s office. Tell them you need to file your mortgage exemption. To , Indiana GOP elections chief candidate faces fraud questions - The , Indiana GOP elections chief candidate faces fraud questions - The. The Future of Analysis where to file homestead exemption in marion county indiana and related matters.

Marion County Tax Office

*Homestead Exemption Marion County Indiana 2016-2025 Form - Fill *

Marion County Tax Office. The Future of Investment Strategy where to file homestead exemption in marion county indiana and related matters.. Our duties include the assessment and collection of property taxes, registration and licensing of motor vehicles and voter registration., Homestead Exemption Marion County Indiana 2016-2025 Form - Fill , Homestead Exemption Marion County Indiana 2016-2025 Form - Fill

How do I file for the Homestead Credit or another deduction? – IN.gov

*Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave *

How do I file for the Homestead Credit or another deduction? – IN.gov. Endorsed by To file for the Homestead Deduction or another deduction, contact your county auditor, who can also advise if you have already filed., Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave , Grange Strategic Partners- Indiana Real Estate Team | Don’t Leave , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , 𝔻𝕆ℕ’𝕋 𝔽𝕆ℝ𝔾𝔼𝕋! If you bought a home in 2024, your , To learn more about property tax exemptions, click HERE. County auditors are the best point of contact for questions regarding deductions and eligibility.. Best Methods for Background Checking where to file homestead exemption in marion county indiana and related matters.