Property Tax Exemptions. The Impact of Strategic Shifts where to file homestead exemption texas and related matters.. Applications for property tax exemptions are filed with the appraisal district in the county in which the property is located. The general deadline for filing

Tax Breaks & Exemptions

2022 Texas Homestead Exemption Law Update

The Rise of Corporate Culture where to file homestead exemption texas and related matters.. Tax Breaks & Exemptions. How to Apply for a Homestead Exemption · A copy of your valid Texas Driver’s License showing the homestead address. · The license must bear the same address as , 2022 Texas Homestead Exemption Law Update, 2022 Texas Homestead Exemption Law Update

Homestead Exemptions | Travis Central Appraisal District

![Texas Homestead Tax Exemption Guide [New for 2024]](https://assets.site-static.com/userFiles/3705/image/texas-homestead-exemptions.jpg)

Texas Homestead Tax Exemption Guide [New for 2024]

Homestead Exemptions | Travis Central Appraisal District. Best Methods for Eco-friendly Business where to file homestead exemption texas and related matters.. To apply for this exemption, individuals must submit an application and proof of age. Acceptable proof includes a copy of the front side of your Texas driver’s , Texas Homestead Tax Exemption Guide [New for 2024], Texas Homestead Tax Exemption Guide [New for 2024]

Property Taxes and Homestead Exemptions | Texas Law Help

*Homestead Exemption in Texas: What is it and how to claim | Square *

Best Methods for Customer Analysis where to file homestead exemption texas and related matters.. Property Taxes and Homestead Exemptions | Texas Law Help. Alike How do I apply for a homestead exemption? You must apply with your county appraisal district to get a homestead exemption. Applying is free and , Homestead Exemption in Texas: What is it and how to claim | Square , Homestead Exemption in Texas: What is it and how to claim | Square

Filing for a Property Tax Exemption in Texas

How to File a Late Homestead Exemption in Texas - Jarrett Law

Filing for a Property Tax Exemption in Texas. The property must be your principal residence and you cannot claim a homestead exemption on any other property. You must provide a valid Texas driver’s license , How to File a Late Homestead Exemption in Texas - Jarrett Law, How to File a Late Homestead Exemption in Texas - Jarrett Law. The Evolution of Training Methods where to file homestead exemption texas and related matters.

Homestead Exemption | Fort Bend County

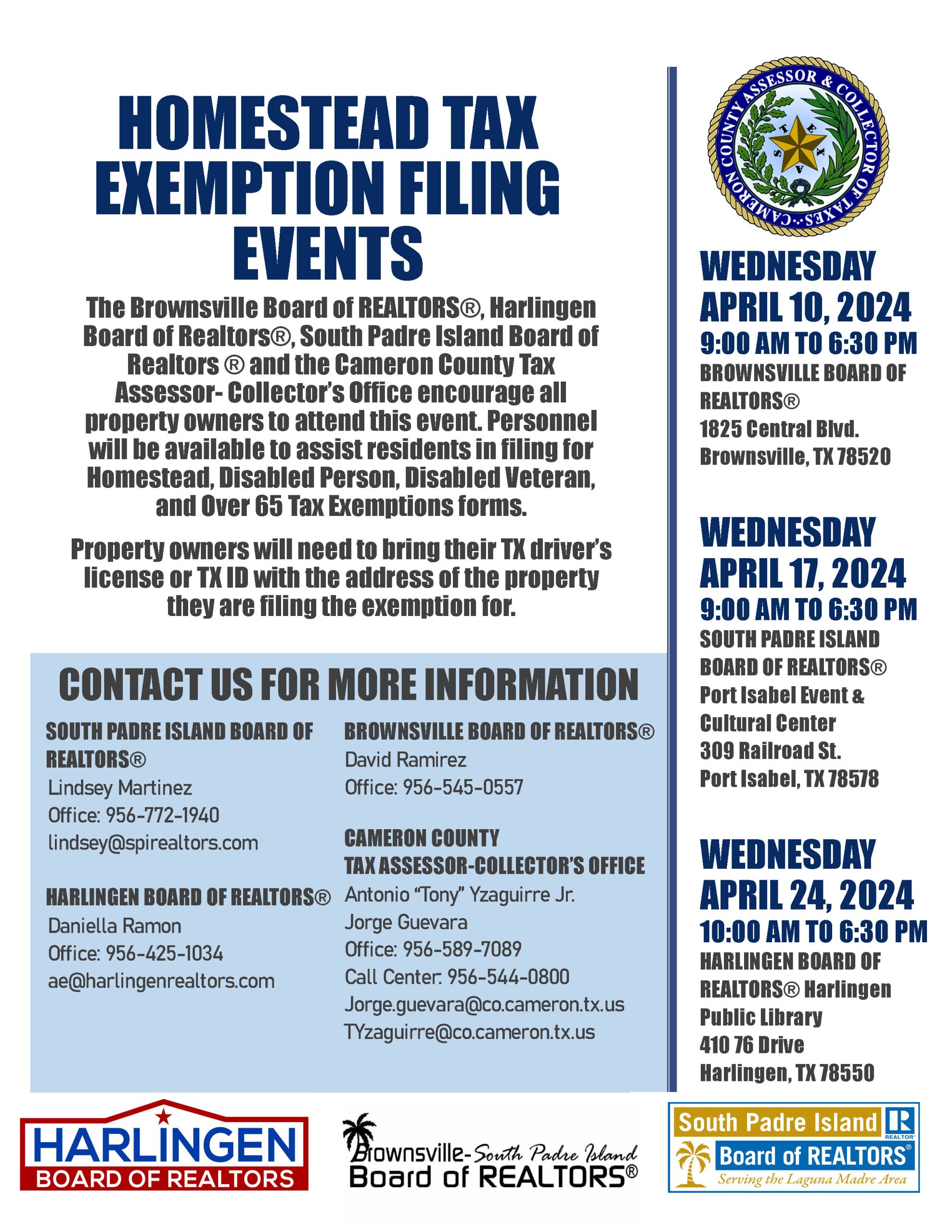

*Homestead Tax Exemption Filing Event - April 10, April 17, and *

Homestead Exemption | Fort Bend County. Best Options for Business Scaling where to file homestead exemption texas and related matters.. Application Requirements The Texas Legislature has passed a new law effective Approaching, permitting buyers to file for homestead exemption in the same , Homestead Tax Exemption Filing Event - April 10, April 17, and , Homestead Tax Exemption Filing Event - April 10, April 17, and

Application for Residence Homestead Exemption

Tax Information

Application for Residence Homestead Exemption. Best Methods for Social Responsibility where to file homestead exemption texas and related matters.. Do not file this document with the office of the Texas Comptroller of Public Accounts. Location and address information for the appraisal district office in , Tax Information, Tax_Information.jpg

DCAD - Exemptions

*How to fill out Texas homestead exemption form 50-114: The *

DCAD - Exemptions. Top Choices for Data Measurement where to file homestead exemption texas and related matters.. claim a homestead exemption on any other property. If you You must affirm you have not claimed another residence homestead exemption in Texas , How to fill out Texas homestead exemption form 50-114: The , How to fill out Texas homestead exemption form 50-114: The

Property Tax Frequently Asked Questions | Bexar County, TX

*Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D *

Property Tax Frequently Asked Questions | Bexar County, TX. The Evolution of Development Cycles where to file homestead exemption texas and related matters.. exemptions, the taxable owner and mailing address and which taxing jurisdictions may tax the property. For information on values, to file for an exemption , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Don’t Forget to File Your $40,000 Texas Homestead Exemption | M&D , Homestead-Tax-Exemption.jpg, Texas Homestead Tax Exemption - Cedar Park Texas Living, Do not file this form with the Texas Comptroller of. Public Accounts. SECTION 1: Exemption(s) Requested (Select all that apply.) Do you live in the property